Whether you are selling your business or passing it to the next generation, maximize the dollars you receive for your hard work over the decades. This series discusses what you need to do to get your business in shape to sell. Your company might be in perfect shape to sell or it might take a few years to get it ready.

Last month, I wrote about the first three of six musts to maximize your selling price:

1. You MUST have clean financial statements.

2. You MUST have inventory on your balance sheet.

3. You MUST have a thriving maintenance program.

This month, I’m writing about the final three:

4. You MUST prove that you have a profitable business.

5. Your business MUST NOT be dependent on you.

6. You MUST NOT have personal expenses as business expenses.

4. Prove that you have a profitable business.

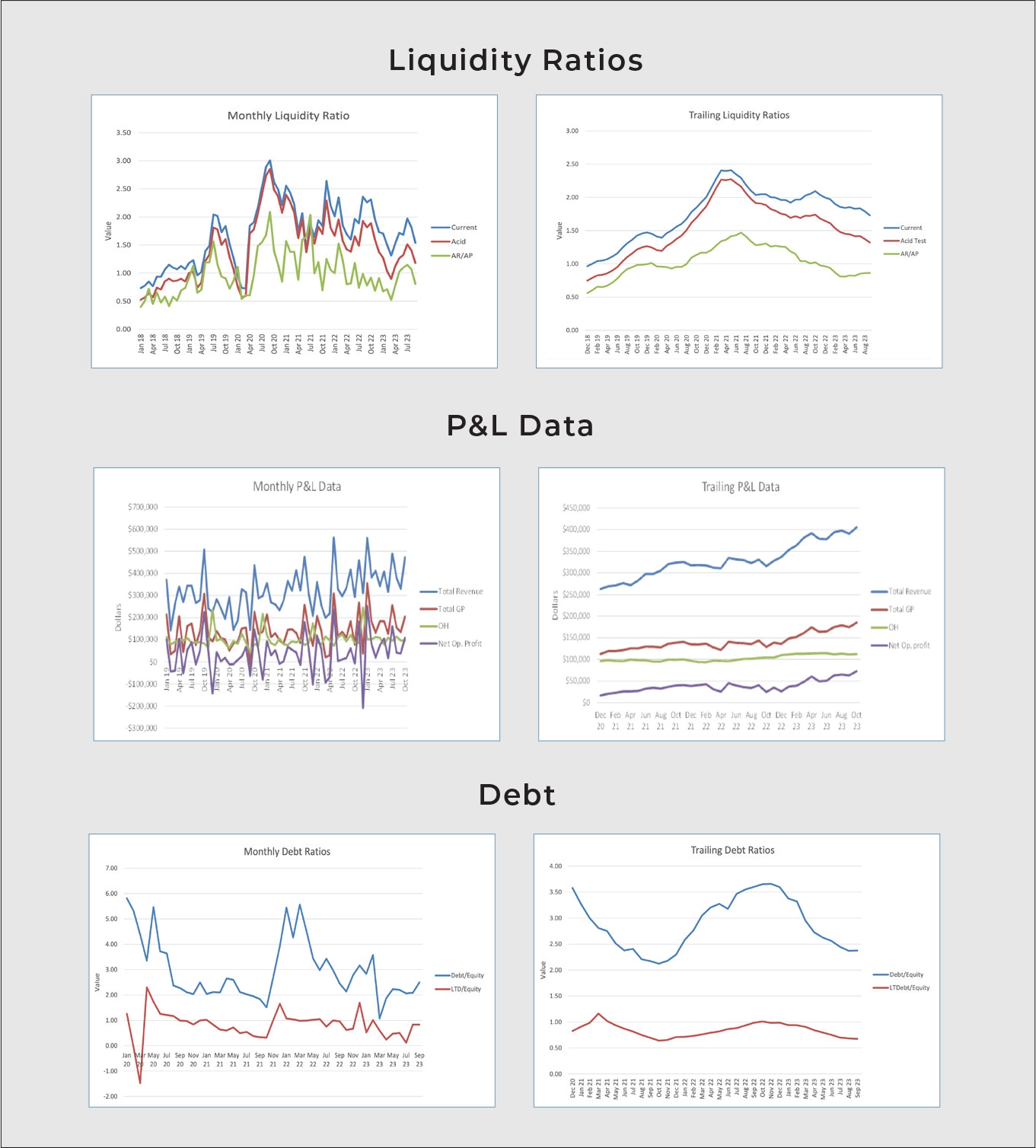

This means three or more years of steady, profitable growth. The best way to show that your company growth is constant and profitable is through graphs of your monthly P&L and Balance Sheet data. Software can help you do this (www.financiallyfit.business).

The monthly graphs will show ups and downs. The trailing graphs should show steady trends in the proper direction. These are the suggested graphs:

• Trailing profit and loss graphs

• Trailing liquidity graphs

• Trailing productivity graphs

• Trailing gross margin graphs

If you don’t show steady, profitable growth, be prepared to explain why not.

5. Your business must not be dependent on you.

A buyer wants to know that it can grow profitably without you. If you, as the owner, are the main salesperson for your business, a buyer will discount the value of your company because of the fear that the major revenue generator is no longer in the business.

If all decisions go through you as the owner, the buyer will, again, discount the value of your business because it may not be profitable without your decisions. Will employees leave because their decision maker is gone? Are your employees capable of making decisions without you? Prove it.

The best way to do it is to have a management team that can operate and grow the business. The team knows their KPIs, how to read a P&L, how to make sure their department is profitable, and how to take care of minor issues before they become major crises.

What if you don’t have a management team? Then, be prepared to sell your business on future revenues. A buyer is not going to take a chance on all the revenues walking out the door when you do.

Typical revenue agreements are 10% of revenues for three years from your existing customer base. Any new customers generated by the new owner don’t count in this formula. For the 10%, the buyer gets your customer list, your maintenance customer list, telephone numbers (including mobile numbers), and all websites/URLs at the time of sale. If you have maintenance customers and have not set aside money to do the work owed to a pre-paid customer, the buyer will deduct these amounts from revenues.

6. Your books have no personal expenses in them.

I know too many contractors that deduct their children’s education expenses, vacations, and other personal expenses on their profit and loss statement.

You must show that there are no personal expenses in the business financial statements. If not, then the buyer will wonder what other expenses you are paying through the company that he doesn’t know about.

A good buyer will ask to see credit card statements from owners and employees. If you allow your employees to put drinks on their gas cards, then the buyer will have even more questions about the ability of the business to run profitably. They may also think that if they institute controls over spending, then the employees who have been getting away with such practices (and know they shouldn’t) will leave. Your revenue generators leave, and the business is worth less.

Next month, I’ll write about specific mistakes that you should take care of before showing financial statements to prospective buyers.

Ruth King has more than 25 years of experience in the HVACR industry and has worked with contractors, distributors and manufacturers to help grow their companies and become more profitable. Contact Ruth at ruthking@hvacchannel.tv or 770-729-0258.