It’s estimated that only 6% of lower middle market HVACR business owners who are considering selling their business in the next 10-15 years, will get their desired business valuation to financially provide for the lifestyle that they and their families deserve.

Sadly, this means that no more than 7,080 of the estimated 118,012 HVACR business owners in the U.S. will have put in the necessary investment and structure to create a company that financially supports their goals well into retirement.

Actionable Steps to Improve Valuation

Now, before we jump into what actionable steps you can begin to implement today to begin improving the valuation of your business, let’s first determine what your financial end goal is to be able to reverse engineer it from there. To accomplish this, you need to determine what annual income you would need if your business was no longer paying for some of the perks that you’ve been able to previously receive from being a business owner (e.g., payments for your cell phone, internet, truck, boat, 5th wheel, “client” dinners, “client” visits, etc.).

Let’s say for purposes of this exercise, you’ve determined that you need to have an annual income of $150,000.00. Next, we need to determine how much you need to have in investments/savings to be able to generate this income annually in perpetuity if you wish to leave a legacy for your family as well. Next, to meet your legacy objective, we need to assume a reasonable rate of return you can expect on this investment. The generally accepted rate of return has been 4%. So, let’s assume that for purposes of this exercise, that is close enough. To determine what investment would generate an annual return of your needed $150,000.00/year, you multiply that number by the inverse of that assumed rate of return (e.g., 1/.04 = 25). Thus, if you were able to generate a return of at least 4% each year, you would need a minimum of $3.7M in investments. Note, that this is the minimum amount that you would need after you’ve paid capital gains taxes, business broker fees, CPA fees, legal fees, and all of the applicable business fees.

For simplicity purposes, let’s say that under your situation if you sold your business for $5M, this would leave you with the required minimum investment we just calculated. Next, you need to have a semi-formal or formal third-party business valuation done on your company. For purposes of this example, when you get your business valuation back, you are going to receive a determination of your company’s overall financial performance which will either be based on your EBITDA (earnings before interest, taxes, depreciation, and amortization) or your (e.g., sellers) annual discretionary earnings (“SDE”) which is a calculation of the total financial benefit that a single full-time owner-operator derives from a business on an annual basis. In addition to this number, the business valuation analysis will also include a multiple, which will be applied to the calculated EBITDA or SDE.

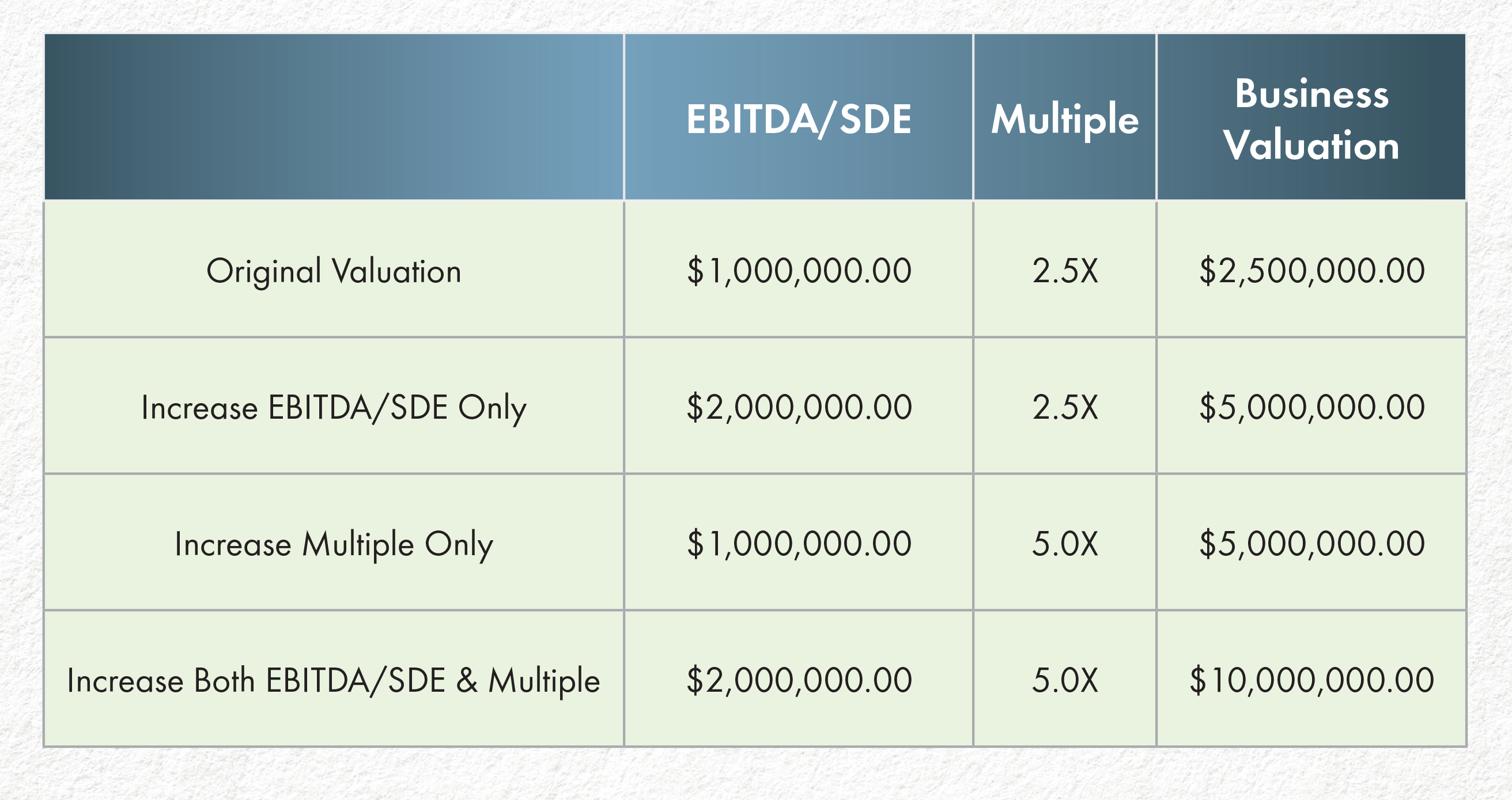

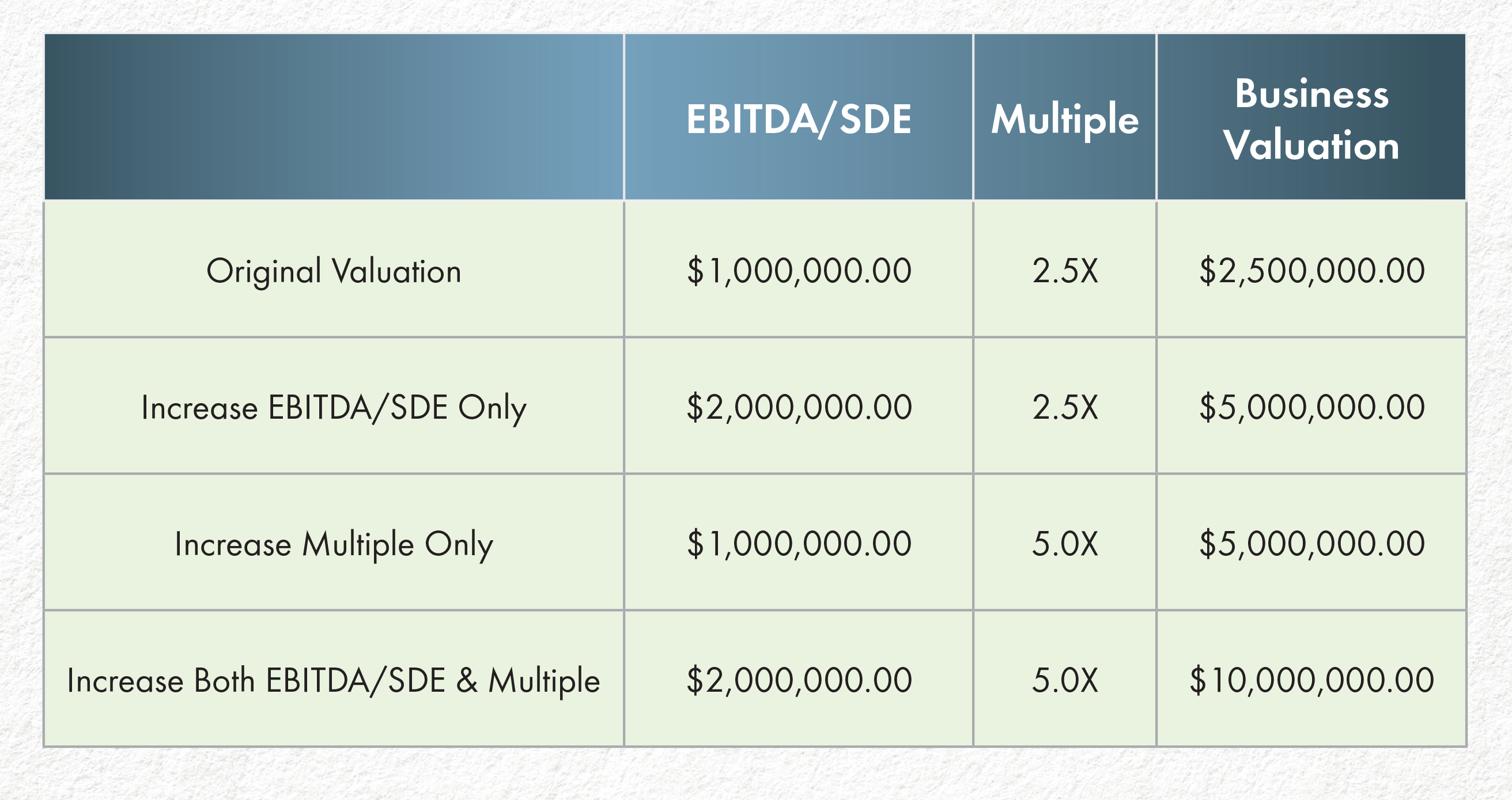

For example, if your business had an EBITDA of $1M and a 2.5X multiple, this would mean that you could expect an offer from a prospective buyer of approximately $2.5M for your business. And in this example, this indicates that you have a $2.5M shortfall to your goal. The good news is that you have three options of places where you can increase your EBITDA/SDE, multiple, or both. See the table below.  As demonstrated in the table, a business owner could achieve the targeted business valuation of $5M by focusing exclusively on increasing their company’s profitability to double their EBITDA/SDE or work to improve the company’s efficiency, structure, processes, and procedures to increase the predictability of the income. This would cause a prospective buyer to increase the multiple amounts offered. Alternatively, those business owners who opt to focus on both factors can see an exponential increase in their business valuation (e.g., $10M instead of $5M), which would allow the business owner not only to provide for their immediate family but potentially create a legacy for all future generations.

As demonstrated in the table, a business owner could achieve the targeted business valuation of $5M by focusing exclusively on increasing their company’s profitability to double their EBITDA/SDE or work to improve the company’s efficiency, structure, processes, and procedures to increase the predictability of the income. This would cause a prospective buyer to increase the multiple amounts offered. Alternatively, those business owners who opt to focus on both factors can see an exponential increase in their business valuation (e.g., $10M instead of $5M), which would allow the business owner not only to provide for their immediate family but potentially create a legacy for all future generations.

Improve Your Company’s Buyer Offers

Improvements in a company’s EBITDA/SDE and improving predictable income (which increases the buyer’s offered multiple and/or both), require the business owner to proactively invest in the right areas of the company. In addition to the business owner’s commitment to implementing these improvements, it also requires an investment of time to train existing personnel, find new members of leadership and management, and enough devoted to transitioning the business to run without the daily involvement of the business owner. The north-star concerning whether your business has met the minimum threshold of being ready is you. As the sole-business owner, you should be able to go on a three-month vacation while the business continues to run smoothly and increase profitability. And as a general timeline, business owners who are truly dedicated to focusing on this should expect to improve their profitability by 50% in the first two years, 3X their profitability in the first three years, and 5-7X their profitability in the first five years.

If you are interested in finding out how your HVACR company ranks nationally in the eight distinct areas that potential buyers use to value a business, and you want to learn what actionable steps you can take to immediately begin improving them, take this free 10-minute assessment available here or scan the QR code now.

Now that you know what your future could look like, it’s time to go and get it!

HVAC business owners who are interested in creating a legacy, by creating a company that can provide financial security for themselves and their families in perpetuity, work with Michael Sauer, Scorpion's Certified Master Business Coach.

www.linkedin.com/in/certifiedmasterbusinesscoach