Americans—especially the affluent—are some of the most charitable people in the world. * Chances are, you use some of your wealth to support favorite causes or organizations that are important to you.

But those contributions may not be having as big an impact as they could—and it’s possible you’re missing out on some valuable charitable tax benefits that could help both you and your favorite charities.

Here’s how to size up the effectiveness of your giving—along with some strategies that could potentially put some real power behind your philanthropy.

The state of affluent giving

A full 74 percent of the affluent say they make significant charitable contributions annually, according to an AES Nation survey of affluent individuals with investable assets of $500,000 or more. That statistic strongly suggests that the affluent are both willing and able to support causes they care about.

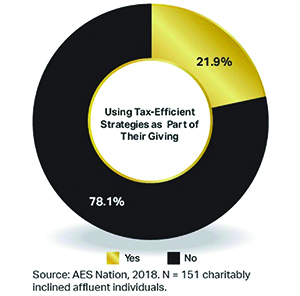

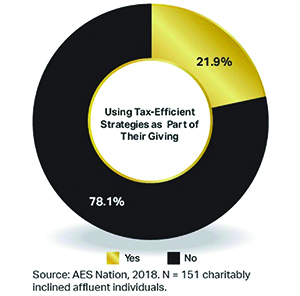

Unfortunately, few of those surveyed donors, are using tax-efficient strategies as part of their annual giving efforts. In fact, as seen in the exhibit, only about one in five is doing more than writing checks to charitable organizations each year.

Tax-efficient giving

Simply put, tax-wise charitable planning is the process of making a significant charitable gift (either during the person’s life or posthumously) that is part of a financial or estate plan—and doing so as tax-efficiently as possible.

We believe tax-wise charitable planning can be accomplished best as part of an overall wealth plan that addresses other key issues such as wealth transfer, wealth protection, and cash flow needs. When affluent donors account for the various assets in their portfolios and the respective structure, it increases the potential to make meaningful charitable gifts that also provide beneficial tax benefits. Generally, proactive wealth planning that takes an affluent donor’s broader financial situation into account can lead to much better outcomes than can so-called checkbook philanthropy, in which charitable gifts are doled out from cash flow.

Important: Effective tax-wise charitable planning focuses first on a person’s philanthropic agenda and then on how to be as tax-efficient as possible. The intention to use wealth to achieve charitable goals is the most critical component of the process.

There are ways, beyond simply writing checks regularly, to make charitable gifts.

Following are three commonly used approaches for tax efficient charitable giving:

- Charitable trusts. There are diverse types of charitable trusts that have variable tax and other benefits for the donors and the charities. Charitable trusts are set up often as a part of comprehensive wealth plans—especially estate plans—because they can potentially mitigate tax penalties and move assets between the generations.

- Donor-advised funds. A donor-advised fund is established typically by a financial services firm, community foundation or charitable group, which manages the fund’s day-to-day operations. Donors make irrevocable contributions to the donor-advised fund, and those assets are invested and grow tax-free over time. Donors can then recommend which charities should receive their financial contributions, and the donor-advised fund makes the grants.

- Private foundations. A private foundation is a not-for-profit organization funded primarily by a person, family, or corporation. The assets in a private foundation, which are called the “endowment,” are regularly invested to produce income used to make grants to other charities as well as to support the operation of the private foundation.

Below are key points to keep in mind about private foundations and donor-advised funds—two of the more commonly used options used by philanthropically motivated individuals.

A private foundation gives the donor maximum control. This is not the case with a donor-advised fund, which technically allows the donor only to recommend which organizations receive money. That said, donor-advised funds in nearly all cases honor these recommendations (assuming the recipient organization is a registered charity).

With a donor-advised fund, the assets are managed by the firm entrusted with the money (such as a mutual fund company or community foundation). With a private foundation, the donor (or his or her advisors) manages the assets.

From a cost perspective, a donor-advised fund is less expensive to set up and manage than a private foundation.

In the case of a private foundation, there are unlimited succession possibilities. This enables a family to exercise control and instill the importance of philanthropy across many generations. In contrast, many donor-advised funds have limitations on succession. In situations where such limitations are reached, the assets in the donor-advised fund go into a general pool at the fund company, community foundation or other sponsoring organization.

Charitable Giving: Making an Impact

Making tax-wise charitable planning an integral part of your wealth planning efforts can be beneficial. That said, the core of tax-wise charitable planning should be your desire to have an impact on one or more charities.

Take some time to think about your own charitable intentions and goals, both what they are today and what they might look like down the road. Armed with that information, you can start to explore and assess several ways to pursue tax efficient philanthropy.

DISCLOSURE: Tax laws are subject to change, which may affect how any given strategy may perform. Always consult with a tax advisor. Charitable Giving, the Tax-Wise Way FLASH REPORT VFO INNER CIRCLE

* Karl Zinsmeister, The Almanac of American Philanthropy, The Philanthropy Roundtable, 2017

Keven P. Prather is a registered representative of and offers securities and investment advisory services through MML Investors Services, LLC. Member SIPC. Call 216-592-7314, send an email to kprather@financialguide.com or visit www.TransitioNextAdvisors.com for additional information.