Two contractors had a 10% net operating profit. One contractor earned $10/hr the other earned $50/hr. Which would you rather be?

Obviously, the $50/hr contractor. The percentages don’t matter. The dollars do.

Gross margins don’t matter either. Here’s why.

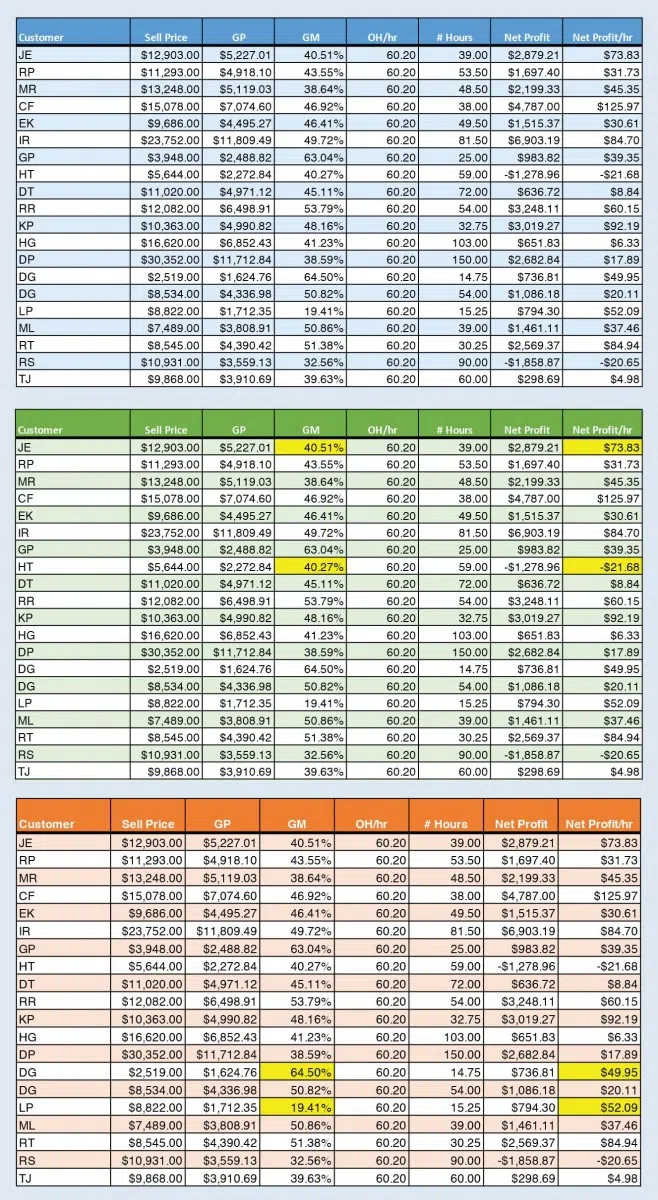

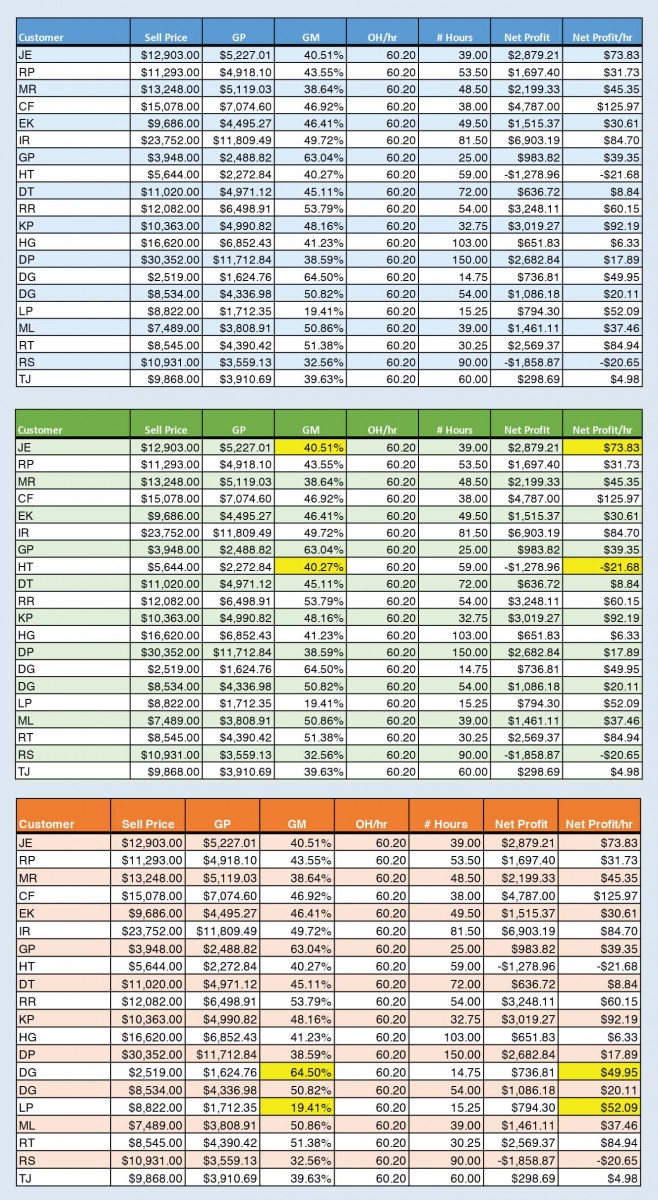

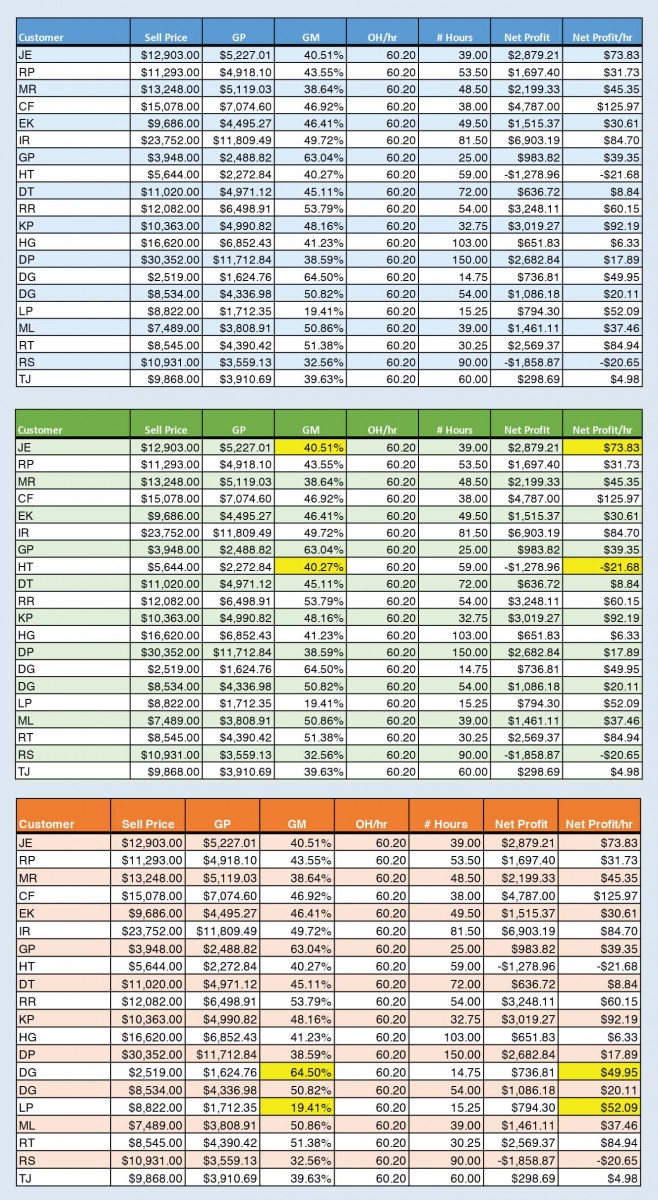

The figure below is the job cost analysis from a contractor I worked with.

Customers JE and HT each had a 40% gross margin. Yet, Customer JE had a $73.34 net profit per hour and Customer HT lost $21.37 per hour. Same gross margins. Vastly different net profits.

Customer DG had a 64.50% gross margin and customer LP had a 19.41% gross margin. The 19% gross margin earned more per hour than the 64.5% gross margin.

Net profit per hour is net operating profit divided by billable (revenue producing) hours. Overhead cost per hour is total overhead divided by billable hours.

You can keep the net profit per hour consistent for every billable hour. Or, you can adjust it based on seasonality. In slower times of the year, you could lower your desired net profit per hour and raise it in busier times.

Here’s an example:

A commercial contractor had several field employees who only worked on project work. The company finished a major project in October and had nothing major on the books until spring of the following year. The owner didn’t want to lay them off because he’d never get the crews back.

A public works job came up for bid. It was perfect – started in December and finished in the spring. The contractor had to get that job.

He bid it at $5 net profit per hour, essentially break even, and won the job. The hours estimate was critical in this bid. When the job finished, job costing showed a little over $6 net profit per hour. The contractor kept his crews and paid his overhead with this job.

Using net profit per hour calculations, you know how low you can go with respect to pricing.

Question: It’s February and you want to at least break even. What’s the lowest price you can offer your customers and still break even?

First, your labor hours have to be accurate. Whenever possible, tell the crew the number of hours they have to install the job. If it comes in at or under those hours, you give them a bonus for making those hours. (I usually put an additional dollar amount in the estimate for this bonus).

For a 16-hour job, I add $80 to the job estimate. Your crews should like a $5/hr raise for completing the job on time.

Here’s how to price:

1. Estimate the number of hours.

2. Multiply your desired net profit per hour times the estimated hours.

3. Multiply your overhead cost per hour times the estimated hours.

4. Determine the direct cost for the job. (Make sure you include commission and credit card/financing fees).

Add 2 through 4.

This is the price to the customer.

In February, a traditionally slower time of year, your desired net profit per hour might be $5 an hour. In July, when you are busy, it might be $200 per hour.

With net profit per hour pricing, you have the ultimate decision on how much profit you want to earn at different times of the year.

Ruth King has more than 25 years of experience in the HVACR industry and has worked with contractors, distributors and manufacturers to help grow their companies and become more profitable. Contact Ruth at ruthking@hvacchannel.tv or at 770-729-0258.