Over the past few months, I’ve written about profit and loss monthly and trailing graphs. Last month I talked about stupid balance sheet mistakes. This month I will cover the second part of the balance sheet graphs series.

First, always make sure the balance sheet is accurate (see November’s column). Next, now that you have reviewed and determined you’re your balance sheets are accurate, let’s go over the graphs.

Three Categories of Balance Sheet Graphs

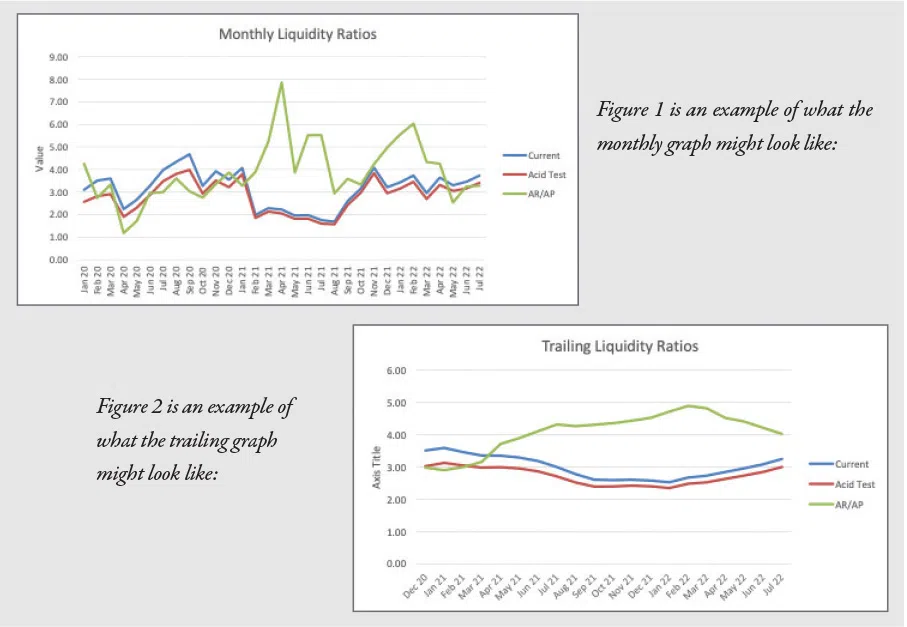

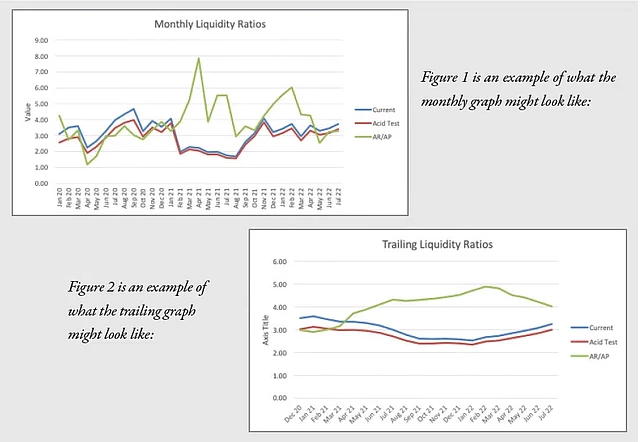

There are three categories of balance sheet graphs: liquidity, debt, and usage. This month I’ll review the liquidity graphs: current ratio, acid test, and accounts receivable to accounts payable.

1. Liquidity Graphs Terminology Defined:

Current Ratio is defined as current assets divided by current liabilities. This ratio tells you whether profitability is increasing and whether the company can pay its bills.

Acid Test is defined as current assets minus inventory divided by current liabilities. This ratio should be at least half of the current ratio or more. If it is lower, then the company has too much money tied up in inventory.

Accounts Receivable to Accounts Payable –This broad term includes cash if more than 50% of the company’s receipts are collected COD. It includes accounts payable plus credit card payments if credit card liabilities are listed separately from accounts payable. If your company has both of these situations, then the ratio is (accounts receivable plus cash) divided by (accounts payable plus credit cards).

Generally, the liquidity graph lines mean:

• Increasing liquidity ratios mean increasing profitability

• Decreasing liquidity ratios mean decreasing profitability

• The graph lines may go up and down if:

(a) You receive a cash inflow (ie PPP loan proceeds)

(b) You pay a huge, non Accounts Payable bill (ie a tax bill)

(c) You purchase a vehicle or another asset for cash

(d) You sell an asset for cash

• Current ratio and acid test lines should be parallel

• If the current ratio and acid test lines are spreading, the company is building inventory

• If the AR/AP line is increasing and receivable days are constant, then profitability is increasing

• If the AR/AP line is increasing and receivable days are increasing, the company is headed for a collection problem

Current ratio graph line:

• If the current ratio is less than 1 the company probably has a cashflow shortage and is having a hard time paying payroll and its bills. Continuous profitable revenue monthly is critical to getting this ratio over 1

• If the current ratio is less than 1 but increasing, then the company is headed in the right direction. Once the ratio gets over 1, cash flow issues should ease

• If the current ratio is over 1 and the ratio is decreasing, then determine why profitability is going down (unless there has been an asset purchase, or a large non-AP bill paid). This generally means that profitability is decreasing, and you are headed for a cash flow issue

Acid test graph line:

• The rules for the acid test follow those of the current ratio – increasing the acid test generally means increasing profitability, etc.

• If the acid test value is less than 50% of the current ratio value, then there is too much money tied up in inventory or inventory is not being accounted for properly on the balance sheet

• If the Acid Test is >1, then look at the AR/AP ratio and Receivable days

• If AR/AP is <1 and receivable days are under 45 days, then the company may have cash flow issues from time to time, but they are not constant

AR/AP graph line:

• A month with high invoicing can increase this ratio. For example, if customers are charged quarterly, and this is the month for quarterly billing, the AR/AP ratio will be higher to reflect billing and no payments for that quarterly billing

• An increasing AR/AP could mean that the company is headed for a collection problem. If receivable days (covered next month) are increasing and the AR/AP ratio is increasing, the company is probably headed for a collection problem

• A decreasing AR/AP could also mean that the company is getting better at collecting or is collecting more COD

Next month I’ll write about the debt and usage ratio graphs.

Ruth King has more than 25 years of experience in the HVACR industry and has worked with contractors, distributors and manufacturers to help grow their companies and become more profi table. Contact Ruth at ruthking@hvacchannel.tv or at 7707290258.