A good debt policy looks at your receivable days and your debt percentages. All residential service work should be COD. All residential maintenance enrollments should be on monthly recurring revenue (preferred) or paid in advance. All residential replacements should be paid upon completion of the job (or the financing paperwork signed on completion of the job).

Commercial work should be billed the day of service. Whenever possible, get a down payment on projects. For larger projects with progress billing, make sure you get your payment requests in on time. Otherwise, you will wait another 30 days to be paid. Always have the ability to get paid by credit card.

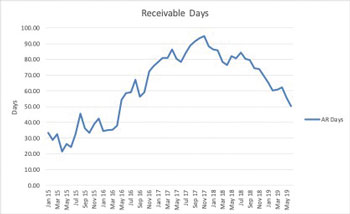

Receivable Days

Receivable Days

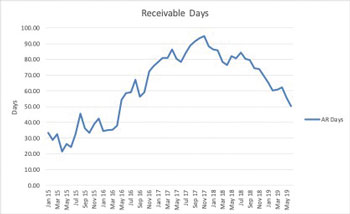

Receivable days are just that, how many days is it from the time you send an invoice to the customer to the time you get paid.

Your company’s receivable days show whether the company is headed toward a collection problem.

Figure 1 shows the trailing receivable days for a client. When the days start increasing collection calls get made and the receivable days decrease again.

To calculate receivable days:

Receivable Turns = Annualized sales

Accounts receivable (+cash)

Receivable days = 365

Turns

If at least 50 percent of your company’s sales are COD, add customer accounts receivable plus cash. Do not include accounts receivable from employees or owners.

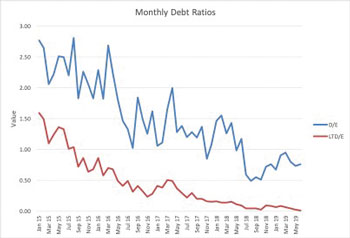

Debt Ratios

Debt ratios are the second part of a good debt policy.

There are two measures of debt, i.e., is your company starting to increase debt or is it too debt ridden? These are the debt-to-equity ratio and the long-term debt to equity ratio.

The debt-to-equity ratio looks at all debt, current and long-term liabilities. The long-term debt to equity ratio looks only at long term debt — those liabilities the companies owes for more than one ye

ar.

These ratios are computed from your balance sheet each month.

To calculate these ratios:

D/E = Total Liabilities

Total Equity (i.e. net worth)

LTD/E = Total Long Term Liabilities

Total Equity

Total Equity

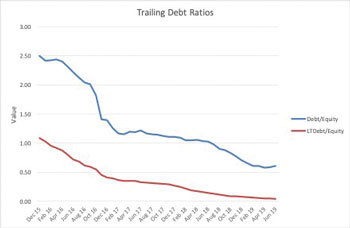

Increasing debt to equity ratios mean your company is becoming more debt ridden. The most critical ratio is the long-term debt to equity ratio. For many businesses, it should be between zero and one. Any value over one means the company has taken on too much debt and it is a burden to the company.

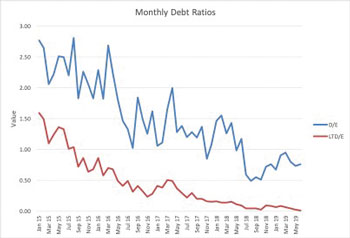

The debt-to-equity ratio doesn’t have “an average value.” I’ve seen this ratio as high as 11 — and the company was still profitable. Most of the time when the debt-to-equity ratio increases dramatically, several large, long-term projects are in their initial stages.

The company is purchasing significant quantities of equipment and materials. When this happens you’ll also see a high jump in accounts receivable, as the company bills for these materials.

Figure 2 shows the monthly graph of the debt ratios. It’s difficult to see what is happening because there are months where the debt-to-equity ratio is high and months where it is low. The long-term debt-to-equity ratio is staying fairly constant.

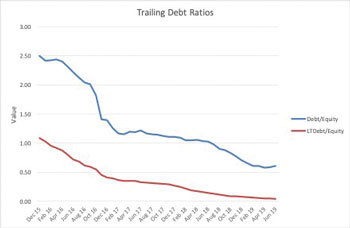

Figure 3 shows the trailing data or the trend of the debt ratios. Each point takes one year’s data and divides it by 12.

The company initially had a lot of short term and long-term debt. Now all ratios are decreasing and the long-term debt is almost negligible.

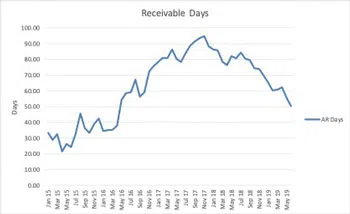

If you find your receivable days are increasing, it’s time to make collection calls. If you find the company’s debt ratios are increasing, find out what is begin spent and whether those expenses are necessary.

Receivable Days

Receivable Days

Total Equity

Total Equity