You’ve decided what you want for 2019 and why you want it. The best way to determine and track your rocket’s course and profits is with net profit per hour.

If you track by net profit percentage, you’re fooling yourself. Why? The first thing you usually do is convert the percentage into dollars and decide whether those dollars are enough. You MUST dig deeper. What do those dollars represent? How many billable hours were used to create those dollars? Then, decide whether those dollars are enough.

Two contractors each have a 10 percent net profit. They both think they are doing well. One contractor’s net profit per hour is $10 per hour. The other contractor’s net profit per hour is $50 per hour. Which contractor would you rather be?

Percentages Not Dollars

The percentages don’t matter. The profit dollars matter. The net profit per hour matters more.

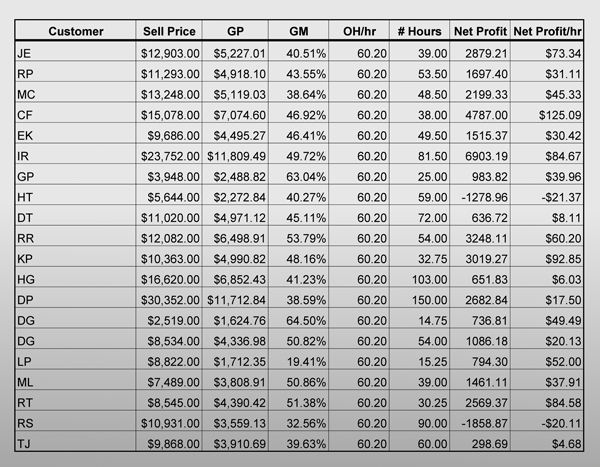

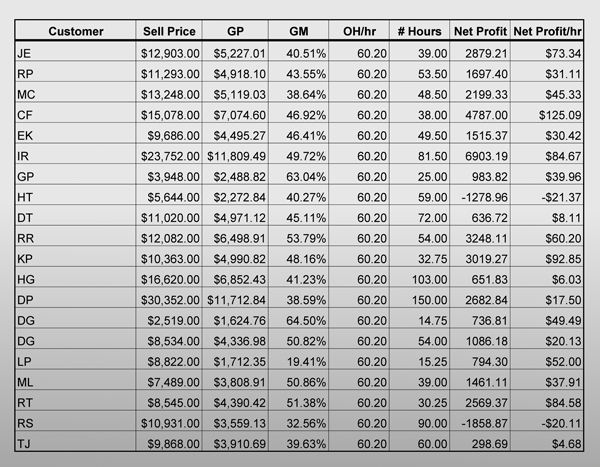

Here’s another reason that percentages don’t matter (net profit or gross margin): See Fig. 1 below.

This is a list of 20 jobs from a client. Since I didn’t know the clients, I wanted to choose the jobs at random because I didn’t want my client saying, “Don’t use that one because …” Or, “use this one because …”

The abbreviations at the top of the chart:

- Customer names are initials to protect their identity.

- Selling price is the price the customer paid.

- GP is Gross Profit.

- GM is gross margin.

- OH/hr is overhead cost per hour.

- # hours is the number of hours that job took according to payroll time sheets.

- Net Profit is gross profit minus overhead. Overhead is calculated by multiplying the overhead cost per hour times the number of hours.

- Net Profit per hour is net profit divided by the number of job hours.

Gross Margins Don’t Matter

The job for Customer JE achieved a 40.51 percent gross margin and a $73.34 net profit per hour

The job for Customer HT achieved a 40.27 percent gross margin and lost $21.37 per hour.

These two jobs had almost identical gross margins. One achieved a net profit. The other lost a significant amount of money.

Here’s another reason gross margins don’t matter:

The job for Customer LP had a gross margin of “only” 19.41 percent, the lowest gross margin on the chart. Many contractors would think this job lost money. Yet, it earned a $52 net profit per hour.

The job for Customer DG had the highest gross margin on the chart, 64.50 percent. It achieved a net profit per hour of $49.49. This net profit per hour is less than the net profit per hour of Customer LP with only a 19.41 percent gross margin.

This is why gross margins don’t matter. The dollars do.

As you prepare to lift off and start your journey towards your goal, make sure you know your company’s desired net profit per hour for the journey. This number is critical when tracking your rocket’s path and the potential course corrections along the way.