Sometimes cash flow issues are due to circumstances beyond your control. A profitable company had three general contractors file bankruptcy within a week of each other. It left him with more than $1 million of uncollectable receivables. He didn’t have the savings to cover it and those bankruptcies put him out of business.

Almost every business runs into cash flow problems at some point. It rarely happens but it does happen. What do you do if you can’t make payroll? Will it bankrupt you too?

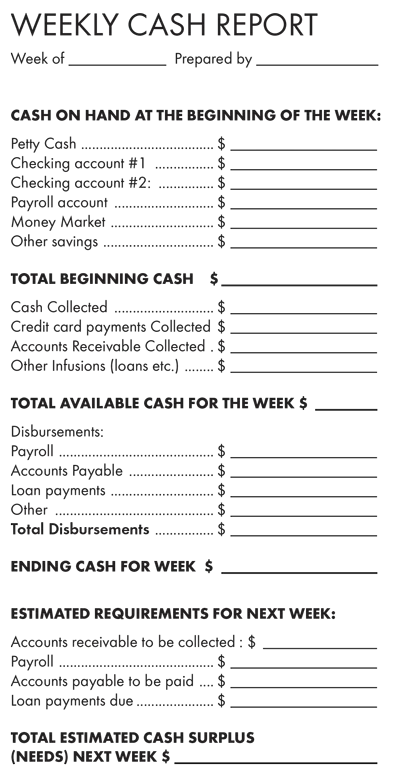

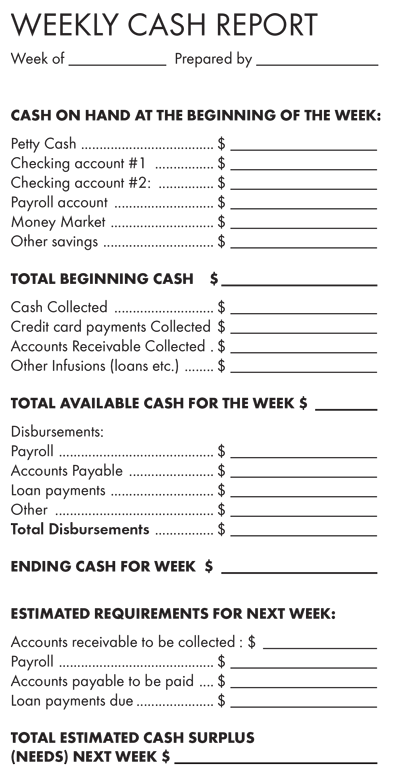

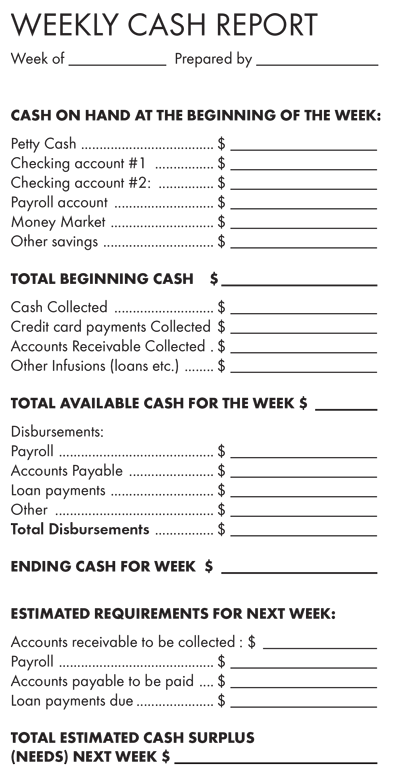

First, you should know about cash shortages the week before they occur. Your bookkeeper should prepare a weekly cash flow report for you every Friday afternoon.

Fig. 1 below shows the weekly cash flow report. The report shows what you started with at the beginning of the week, what money came in, what money was disbursed, and the projections for the following week.

If the weekly cash flow report shows that you won’t have enough money for payroll, at least you are taking action the week before.

To generate the needed cash you could:

• Call past due customers and get payment.

• Review your outstanding proposal and close jobs (get deposits when the sales are won).

• Call customers (whether maintenance customers or not) who haven’t had maintenance and give them a reason to perform the maintenance. Your technicians will find work on those calls. Since they are COD, then the cash comes in quickly.

• Call customers who haven’t renewed their maintenance plans and get them to renew.

• Review your tickler files for work the technicians recommended that the customer said, “not now.”

• Transfer cash from personal savings or personal credit cards.

But, what if you haven’t done a weekly cash flow report and your bookkeeper tells you that you don’t have enough money in the bank to make payroll and payroll is the next day?

Think about who you know who could loan you money quickly. You might have it in personal savings. A friend or relative might be able to loan money to you. Say how much you need and when you will repay it.

If no personal savings, friends or relatives come to mind then, quite frankly, you’re in trouble. You have to decide who to pay and who not to pay. Field people come first. Without them, you can’t generate revenues. Office personnel are paid next. Then managers. You are last.

You, as the owner, have the hard decisions and the hard conversations. Let the employees who are not paid know when they will receive their checks. Unfortunately it may start rumors that the company is in trouble and employees will start looking for employment elsewhere. Get them their payroll as soon as possible.

Here are four procedures that will help eliminate the possibility of not making payroll. None of them will generate cash instantly. They all take time to accumulate cash.

- A bank line of credit. I’ve seen banks change policies or get sold and decide they don’t want construction type loans. They have called contractors’ lines of credit, even when the loan payments are current. It has put contractors out of business. However, if you go this route, then apply for a line of credit when you don’t need it. Apply when cash and profits are plentiful. That’s the best opportunity for the banker to say yes.

- Have an operations savings account, so that you don’t have to rely on a banker saying yes or no. Put 1 percent of every dollar that comes in the door into the account. If you generate $2 million per year, that is $20,000 in your savings account each year.

- For residential companies, put as much of your maintenance plan money away as possible. I recommend saving at least 50 percent of it when you get the money in advance. If you are on monthly recurring billing, many companies have the monthly payments go into a savings account rather than their operating checking account.

- For commercial maintenance, put away your profit percentage. If you’ve estimated a 5 percent net profit on that maintenance plan, put 5 percent of the money you receive into the savings account.

Be prepared so that you can always make payroll. Be your own bank.