Putting systems in place keeps the honest people honest. I discovered this really sneaky and ingenious way to steal from your company when a contractor called me and asked if I would help him make sure his pricing was correct.

I said yes and asked him to send me his year-end Profit and Loss Statement and Balance Sheet for the past two years.

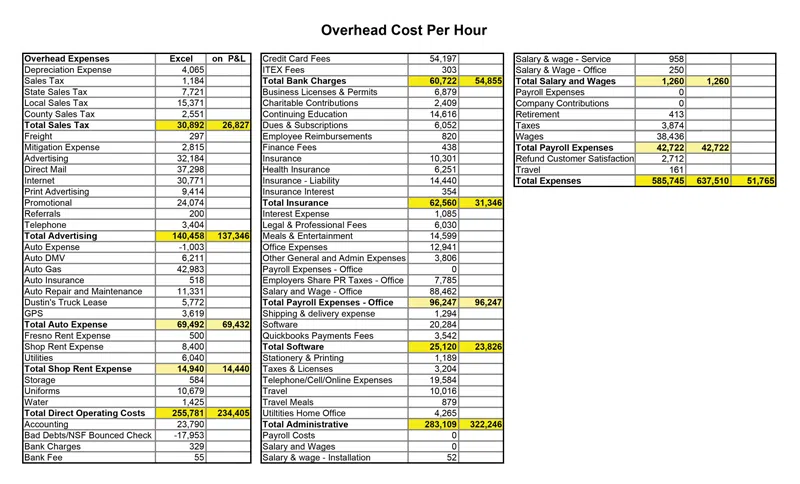

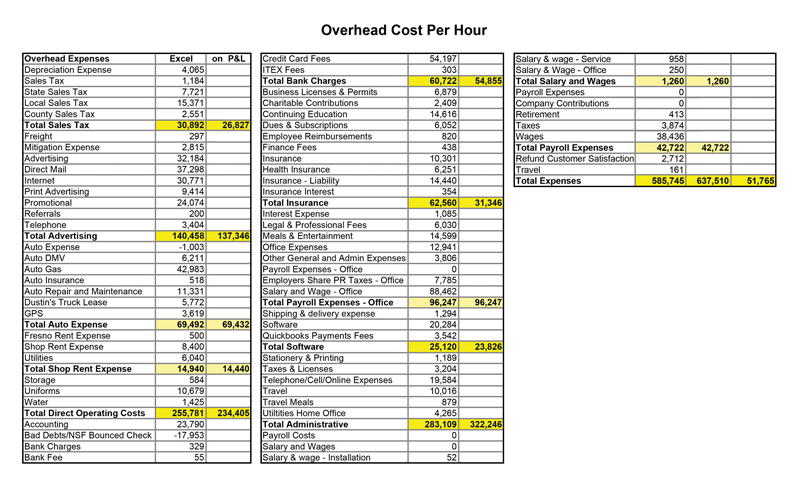

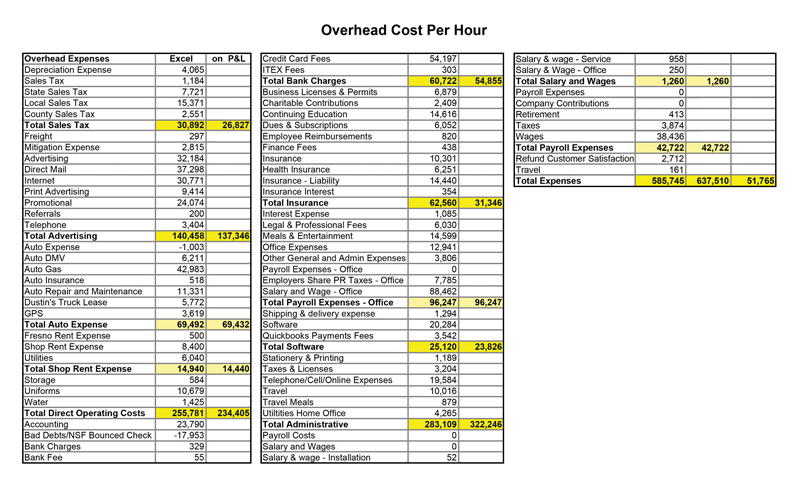

When I got his financial statements, I put his expenses in my overhead calculation sheet to calculate his overhead cost per hour. The expense totals didn’t match what was shown on his profit and loss statement.

At first I didn’t believe it, even though it was Excel — and Excel never makes an addition mistake. So, I added up the numbers on an old fashioned adding machine. Numbers didn’t match.

I realized that this was the most, unfortunately, creative way to steal I had seen in more than 30 years. No one, including me, thinks to put the numbers you see on your profit and loss statement into an Excel spread sheet to ensure the numbers match. Until now.

Fig. 1 shows the numbers from the company’s profit and loss statement in comparison to the numbers that I calculated.

You can see the differences.

There are some categories, such as auto expenses, where the spreadsheet matched the numbers on the contractor’s profit and loss statement. There were many more, however, that didn’t add up.

|

Fig. 1 (click to enlarge)

|

When you total the numbers, my calculation was $51,765 less than what was stated on the company profit and loss statement.

Long story short — the contractor’s P&L said expenses were $637,510. The Excel spread sheet added to $585,745. There was more than $51,000 missing!

But, you say, how do they get away with it? It’s easy to create journal entries to change the numbers on your financial statements because journal entries never appear on your financial statements.

Decrease the expense. Decrease the cash. Or, create a business checking account with a legitimate sounding name and write checks to that account. Or, if you have petty cash and don’t reconcile it, that is an easy way for the embezzler to steal.

Remember this is only a few hundred dollars taken from many different accounts over a year’s time period. The busy contractor who doesn’t pay attention never catches it.

This is a great way to steal from you. You almost never add up the numbers on the P&L. You assume that they are right … $51,000 out the door is easy to hide because of your assumption. A few dollars here. A few dollars there. No one will ever catch it!

Keep the honest people honest by entering your expenses stated on your P&L into an Excel spread sheet. You don’t have to do it every month. You should do it a few times a year.