Pricing maintenance, service and replacements is based on the profit and loss statement. In the 1950s contractors, were taught to use mark up on cost to price. This resulted in many contractors losing money because mark up is on cost rather than profit.

Then contractors (myself included) were taught to divide direct cost by 1-Gross Margin (1-GM). This still gives you a false sense of security. The reason being, overhead is not taken into consideration in either of these two pricing models.

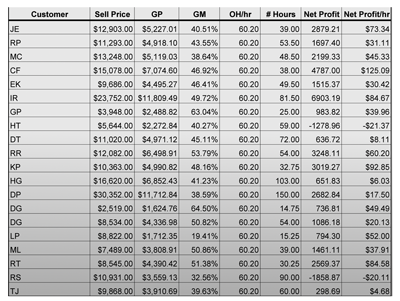

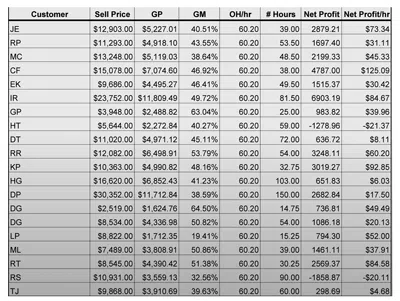

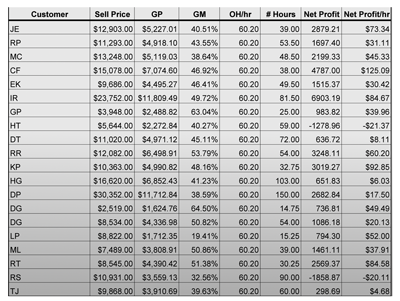

The figure shows why dividing by 1-GM is dangerous. These are actual jobs from a contractor with whom I worked (the names are initials to protect the customers).

Look at the first line, Customer JE. The gross margin on his job is 40.51 percent and the net profit per hour is $73.34. Customer HT is on the eighth line. The gross margin on his job is 40.27 percent, nearly identical to Customer JE. Yet, the net profit per hour is -$21.37.

The company PAID Customer HT $21.37 for every hour they worked on the job!

All pricing follows the profit and loss (P&L) statement format:

Revenue

- Cost of sales (direct cost)

= Gross profit

- Overhead

= Net operating profit

Knowing the net operating profit per hour (NPH), the overhead cost per hour (OPH) and the number of hours the job takes gives gross profit. Add the cost of sales to the gross profit to determine the job revenue price.

Net profit per hour is the profit generated for each billable (i.e. revenue producing) hour.

It is defined:

Net Profit per Hour (NPH) = Total net operating profit ÷ billable (revenue producing) hours

Overhead cost per hour is the overhead you must cover for each billable (i.e. revenue producing) hour.

It is defined:

Overhead cost per Hour (OPH) = Total overhead ÷ billable (revenue producing) hours

Determine how many revenue producing (i.e. billable) hours the company had last year. This is the number of hours that were billed to a customer, the number of hours that were spent producing products and services or both. It does not include holidays, vacations, meeting hours, training hours or hours they spent "sweeping the shop."

Get last year's total overhead and net operating profit (i.e. net profit before other income, other expenses and taxes) from your profit and loss statement. Put them in the formulas above to calculate your overhead cost per hour and net profit per hour.

If the company had a loss last year, the company PAID its customers to provide the products and services it sold to them.

To calculate pricing for 2016, determine the net profit per hour you want, add it to the overhead cost per hour to determine the gross profit per hour you want. Then, multiply this number by the total number of estimated hours on the job and add the direct costs for that job. This is the price to the customer.

As the owner, you determine the net profit per hour you want for each billable hour. It can be different, depending on different departments. For example, you may want $50 net profit per hour for service while desiring $200 per hour for replacing a high efficiency HVAC system.

Calculating pricing using net profit per hour ensures your overhead costs are covered in each job. Labor productivity is watched because your profits are totally dependent on the number of hours that a job took. You will soon notice good crews and bad crews; productive field labor and non-productive field labor. This is a training opportunity or a "find another employee" opportunity because a non-productive employee costs you money.

Ruth King is president of HVAC Channel TV and holds a Class II (unrestricted) contractors license in Georgia. She has more than 25 years of experience in the HVACR industry, working with contractors, distributors and manufacturers to help grow their companies and make them profitable. Contact her at ruthking@hvacchannel.tv or call 770-729-0258.

Ruth King is president of HVAC Channel TV and holds a Class II (unrestricted) contractors license in Georgia. She has more than 25 years of experience in the HVACR industry, working with contractors, distributors and manufacturers to help grow their companies and make them profitable. Contact her at ruthking@hvacchannel.tv or call 770-729-0258.

Ruth King is president of HVAC Channel TV and holds a Class II (unrestricted) contractors license in Georgia. She has more than 25 years of experience in the HVACR industry, working with contractors, distributors and manufacturers to help grow their companies and make them profitable. Contact her at

Ruth King is president of HVAC Channel TV and holds a Class II (unrestricted) contractors license in Georgia. She has more than 25 years of experience in the HVACR industry, working with contractors, distributors and manufacturers to help grow their companies and make them profitable. Contact her at