A contractor had never reached $200,000 in the two slowest months of the year. We decided to hold a contest to see if the company could exceed $200,000 in these months. When we calculated the numbers, we found that, assuming the company kept its pricing the same, each employee could earn $200 if they reached the goal in one month and $500 if they reached the goal in both months — and the company would stay profitable.

The company reached the goal in the first month and just missed it in the second. Everyone received $200. The funny part is that most of the employees had spent the $200 before they earned it. They were saying, “I’m going to buy X with the money.”

What this contest did for the long term was prove to everyone that the company could exceed $200,000 in sales in slower months; and they did every year thereafter.

Contests are a great way to build your bottom line as well as give employees something to reach for — and they can build positive morale.

Besides revenue contests, my favorite contests are for maintenance agreements. You can create a contest for any type of activity; simply make sure that after the prizes are distributed, the company is still profitable in that activity.

Hold a meeting to explain what the overall goal is and ask for input. Then, once you get input, create the contest. Remember this is a group contest. Everyone wins or everyone loses.

For example, when you establish a contest for maintenance agreement enrollments, they should be for short periods. Everyone participates. It’s okay to recommend and enroll only one client to be a part of the program. At a minimum, however, the technicians should get one agreement for every three people they talk to about them. So, if they have 300 opportunities, 100 new maintenance agreements should be enrolled.

Set a contest with your employees to reach a maintenance agreement goal. Make sure everyone has bought into the need for the agreements. Then, start small with a three-month contest period.

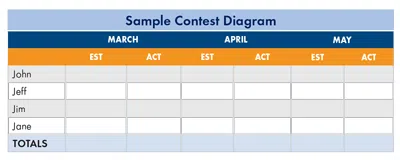

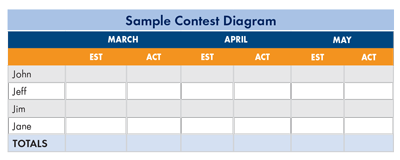

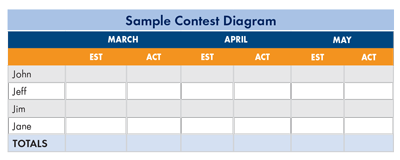

Take a piece of poster board or put a chart on a white board. Along the X-axis should be the months. For example, March, April, May. Underneath each month should be two columns, one labeled Estimated and one labeled Actual. Along the Y-axis should be everyone who is in contact with clients: service technicians, dispatcher, sales people and others who have the opportunity to enroll clients in your maintenance agreement program.

Ask each person how many they think they can enroll during that three month period. Put that estimate in the EST column for each month. On average, you will get two no’s for every yes. So, if a technician thinks he can enroll 30 in March, he has to have 90 opportunities in March. After you get everyone’s estimates, total the estimated agreements for the company. This is your three-month goal.

At the end of each month, record the actual numbers on the chart. At the end of the three-month period, determine the results. This tracking is critical so everyone sees where the company is in relationship to the goal.

My rule about contests: The company as a whole wins or loses. There are no individual winners. Why? If you have an individual winner, then as he gets further and further ahead, everyone else will stop trying. With only a group goal, the entire group is always in the game. And, if someone is under his estimated number, a person over his estimated number can pick up the slack for the group as a whole.

The prize, in addition to the maintenance SPIFs, is determined by the group. One of my favorites is the group gets $X in gift cards to a store of their choice.

There is a group penalty for not achieving the goal. The reason for the penalty: Some people do better when there is a fear of losing rather than winning. My favorite penalty: Each person has to teach a class and bring the donuts. Even a dispatcher can teach a class about paperwork.

Try a contest in 2017. It could increase your bottom line.