What's most important; cash, cash flow or profits? Whenever I ask this question in a contractor group meeting, about 50 percent of the contractors get it wrong.

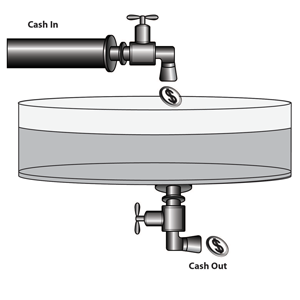

The answer is illustrated in Fig. 1, which is out of my book, "The Courage to be Profitable"

Think about a tank filled with water. The level of the tank rises and falls depending on whether you're adding water to the tank through a spigot, or decreasing water from the tank through a drain.

Now, imagine the water in the tank is the number of dollars in your checking account. If cash were the most important, then every month the level of cash in the tank would decrease. You drain cash to pay your payroll, inventory, rent, vendors and other expenses. Soon, the level would be at zero and you would be out of business.

Cash flow is next. The level of water, i.e. your cash, increases when you open the spigot and add to it through collections on sales (notice I said collections on sales, not just sales), personal or investor loans to the company, interest on investments, tapping your line of credit, equity investments or selling assets. These are the major additions to cash. There are some other, uncommon additions not included.

The level of water, i.e. your cash, decreases when you open the drain to pay for inventory, payroll, rent, utilities and other direct and overhead expenses.

The level of water, i.e. your cash, decreases when you open the drain to pay for inventory, payroll, rent, utilities and other direct and overhead expenses.

Every time you add cash to the tank through collections on sales, etc., the level of cash in the tank rises. Every time you write a check, the level in the tank drops. Cash coming in to cover cash going out is important.

Here's why profitable sales are more important than cash flow:

A contractor started his business and, during a 12 year period, grew it to $2 million in revenues. He ran the business on cash — as long as he had cash in his pocket, life was good. During the growth phase, he always took his vendor discounts and had plenty of cash.

When the company hit $2 million in revenues, the growth stopped. Soon, he started having cash flow problems — he couldn't take his discounts and sometimes had to scramble to make payroll. When I analyzed his business, the company was losing a nickel for every dollar it took in the door.

The growth masked the profitability problem.

Yes, cash flow was good. But … the level of cash in the tank was rising at 5 percent less than it should have been rising. When growth stopped, even with cash flow inputs, the tank level was decreasing 5 percent every month.

Although cash is king and is used to pay all of your bills, cash flow is important, but profitable sales turned into positive cash flow is critical.

Ruth King is president of HVAC Channel TV and holds a Class II (unrestricted) contractors license in Georgia. She has more than 25 years of experience in the HVACR industry, working with contractors, distributors and manufacturers to help grow their companies and make them profitable. Contact her at ruthking@hvacchannel.tv or call 770-729-0258.

Ruth King is president of HVAC Channel TV and holds a Class II (unrestricted) contractors license in Georgia. She has more than 25 years of experience in the HVACR industry, working with contractors, distributors and manufacturers to help grow their companies and make them profitable. Contact her at ruthking@hvacchannel.tv or call 770-729-0258.

The level of water, i.e. your cash, decreases when you open the drain to pay for inventory, payroll, rent, utilities and other direct and overhead expenses.

The level of water, i.e. your cash, decreases when you open the drain to pay for inventory, payroll, rent, utilities and other direct and overhead expenses. Ruth King is president of HVAC Channel TV and holds a Class II (unrestricted) contractors license in Georgia. She has more than 25 years of experience in the HVACR industry, working with contractors, distributors and manufacturers to help grow their companies and make them profitable. Contact her at

Ruth King is president of HVAC Channel TV and holds a Class II (unrestricted) contractors license in Georgia. She has more than 25 years of experience in the HVACR industry, working with contractors, distributors and manufacturers to help grow their companies and make them profitable. Contact her at