Enact a profit sharing program, rather than a bonus entitlement.

It was the day of the employee Christmas party. That afternoon, a contractor was trying to determine the Christmas bonus for each employee. They didn’t have a good year, however, the employees expected a check at the holiday party.

To make matters worse, the employee who had been there the longest and got the biggest check last year, expected at least that much this year. Unfortunately, he’d actually cost the company money this year.

There was no standard method to determine the holiday bonus. The employees felt entitled to the check. They didn’t care the company didn’t have a profitable year.

This year, the company will have a profit sharing plan — not a gift at Christmas.

If your company has a profitable year, you should share a piece of the profits with employees who helped generate the profits. If your company had a loss, then no profit sharing is earned and no holiday bonus is earned either.

When employees understand a method to determine profit sharing and how their job impacts the bottom line, they’re much more willing to help generate those profits. When you keep them informed monthly or quarterly, they’ll know what the company profits are for that time period and they’re not surprised at a small or large profit at the end of the year.

You should also distribute profit sharing after your year is closed, which usually means January or February (so, no checks will be distributed at your holiday event). Of course, the first year that you implement this program, you have to remind employees the profit sharing checks will be distributed after the year is closed, and not to expect a holiday check.

How it Works

Here is my profit sharing formula:

- Determine the percentage of yearly profits that will be distributed to employees. My philosophy is not to distribute more than 25 to 30 percent of the profits. The remaining 75 percent need to be retained in the company for future growth, additional wages, other expenses and, of course, your share as the owner.

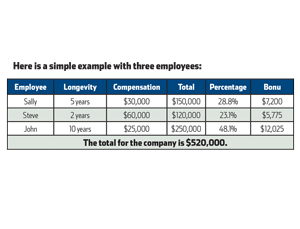

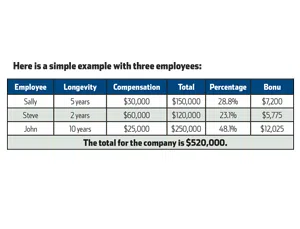

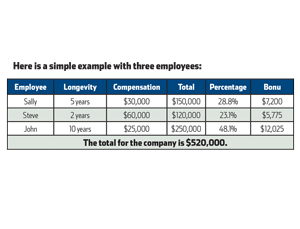

- To calculate each employee’s share, multiply their compensation by the number of years they have been employed by your company. You reward longevity.

- Add the totals for all employees. That is the denominator of the equation.

- To calculate a specific employee’s percentage, take his total and divide it into the total for the entire company.

Assume your 2015 profits will be $100,000. You distribute 25 percent of the profits ($25,000) through the profit sharing plan.

Sally receives 150,000/520,000 or 28.8 percent. Her bonus is 28.8 percent of $25,000 or $7,200.

A question that contractors often ask is, “Do I still need to give a bonus to a person who has been screwing up and in my opinion doesn’t deserve it?” The answer is yes. This structure is for everyone.

A question that contractors often ask is, “Do I still need to give a bonus to a person who has been screwing up and in my opinion doesn’t deserve it?” The answer is yes. This structure is for everyone.

I’ve found when you use this profit sharing plan year after year, by the third or fourth year you won’t have to fire non-productive people. Your employees will do it for you by making that person’s life so miserable that he or she quits. They understand this person is affecting their profit sharing bonus negatively and want that person gone.

The other thing I find is you will attract better employees. People want to work for a company where hard work is rewarded. It sets you apart from the competition.

Reminders

Make sure you keep everyone informed each month. It’s important everyone knows what’s happening with profits.

To keep all employees abreast of the financial profitability of the company, one contractor puts a thermometer in the break room. The top of the thermometer is the amount of profit the company wants to generate each year. Every month the CFO adds the year to date profit on the thermometer and each employee knows his or her approximate percentage of that profit so they can compute their estimated profit sharing each month.

Another contractor gives half the profit sharing bonus right before the busy season starts. No one complains about having to work hard, how busy it is or about the telephone ringing off the hook. They know if they work hard and generate even more profit during the busy season, their check at the end of the year will be even larger.

If you’ve been giving holiday bonuses every year without a structured reason for those bonuses, then break the habit in 2015. Establish a profit sharing plan instead.

A question that contractors often ask is, “Do I still need to give a bonus to a person who has been screwing up and in my opinion doesn’t deserve it?” The answer is yes. This structure is for everyone.

A question that contractors often ask is, “Do I still need to give a bonus to a person who has been screwing up and in my opinion doesn’t deserve it?” The answer is yes. This structure is for everyone.