Chances are, you’re not in business just because you are passionate about heating and cooling. At the end of the day, we all need to get paid for the work we do – to support our families, to make payroll, and to reinvest in our businesses. How we get paid has changed significantly over the last decade or so.

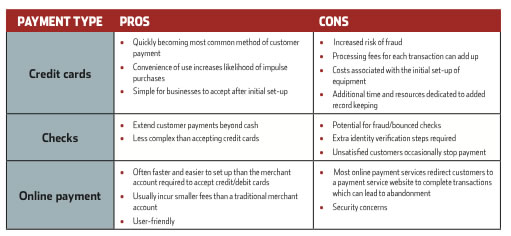

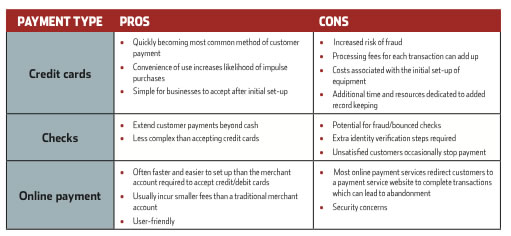

Fewer and fewer people are using cash for even small purchases like gasoline or their daily latte. According to a 2012 MasterCard survey, 61% of 30-39 year-olds and 44% of those 55 and over look forward to a cashless society. As customers adjust their payment forms, HVACR owners should welcome e-payment methods. This article summarizes information from the Small Business Association (www.sba.gov) to help you make savvy decisions about accepting checks, credit cards, and online payments. The table below lists the pros and cons of the three common forms of payment.

ESTABLISH POLICIES TO AVOID FRAUD

Regardless of which forms of payment you accept, you need established verification practices to protect your business from fraud and security breaches. Train new staff on these procedures and refresh their memory periodically in case any questions emerge.

Policies for Accepting Credit Cards

- Ensure there’s a paper trail. With signed receipts and credit card slips, a designated waiting period to lapse there’s a good chance you can prove that the service was provided to the cardholder.

- Check the signature on the draft against the signature on the back of the card. If the signatures do not match up, have the customer sign again or ask for a piece of I.D. If you are still not satisfied, call for authori- zation to confirm the validity of the card.

- Check the expiration date. Cards are often mistakenly used before their initiation date or after their ex- piration date.

- Pay particular attention to the 4-digit printed number (BIN) to the left of the embossed account number, above or below. It should match the first digits of the embossed account number. If the printed BIN is not there, the card is most likely counterfeit.

- Be especially vigilant with gold cards. Because of their higher spending limits, gold cards are favorite targets of fraud artists.

Policies for Accepting Checks

Common check policies include variations of these guidelines:

- Checks must be from a local or instate bank.

- Checks should not be written and accepted for more than the purchase amount.

- Checks should not be accepted that are starter checks, unnumbered checks, or non-personalized checks.

- Accepted checks should be deposited no later than the next business day.

Instruct your employees to carefully examine every personal check for information that is essential for chashing the check:

- Personalization — The customer’s complete name and address must appear on the check.

- Date — The check date must be current. Do not accept post or future dated checks.

- Bank I.D. numbers — The check must have a bank identification number, or outing transit number, that runs across the bottom, along with the customer’s account number and check number. This information is used by a bank to identify the transaction and resolve payment issues.

- Payee — The “pay to the order of” section must indicate your business’s name.

- Dollar amounts — Both the written and numeric amounts must match.

- Customer signature — The check should be signed in your presence and verified with photo identification

Online Payment security

- Major providers of online payment services have developed features like two-factor authentication to help businesses enhance e-commerce security. Two-factor authentication requires businesses to enter a six digit code in addition to their password, making third-party scams rare.

- As e-commerce becomes more popular, security features will continue to evolve. Be sure to research service provider plans for the most current security technology.

WHEN THINGS GO WRONG

Sometimes, despite our best efforts to verify and secure a customer’s identity, bad things happen. We’re all woefully aware of the security breach at Target Corp., which cost the company $17 million ($61 million in losses, offset by $44 million in insurance coverage). However, this sort of security breach at a large retail chain is rare. Small businesses like HVACR companies are even easier targets.

Security breaches

You don’t want to make the news because of an information leak. As a business owner, it’s important to take data security very seriously – it should be grounds for termination, so be sure to discuss it with your employees. If you suspect that a customer’s personal data has been shared without their approval, visit www.nscl.org to find the current notification regulations in your state. Notify your customer and the proper authorities immediately.

Bounced checks

What should you do if a check is returned because a customer’s account is closed, or has insufficient funds to pay for the transaction? In addition to instituting a check policy, some new businesses are employing the help of electronic check verification companies to identify flagged individuals. For a monthly fee, businesses can compare a customer’s name against a database of individuals that are known to have written bad, stolen or forged checks.

Even with precautionary measures in place, businesses that accept checks may still have a bad check occasionally slip by. If a check fails to clear on your first attempt, your bank will generally attempt a second deposit. In some cases, the customer can quickly resolve the problem by transferring or depositing funds to cover a bounced check. If the customer does not resolve the issue, you can consult your local law enforcement agency to understand your rights and options. Some states require businesses to mail a registered letter and allow a designated waiting period to lapse before further action is taken.

If the issue remains unresolved, consider filing a suit with a small claims court or employing a collection agency to resolve the payment. Many businesses choose to employ a collection agency to avoid a lengthy and expensive court settlement. For more details about check fraud, please see our October 2008 article Check Fraud Checkup by Frank Abagnale.

Dissatisfied customers

Occasionally, you’ll find a customer has stopped payment on a check if they believe the products or services bought did not live up to expectations. If this is true, customers may be entitled to a refund or a reduction of the amount owed.

PREVENTION IS KEY

The best way to solve these situations is to prevent them from happening in the first place. Be sure to establish thorough identification verification policies, and train and retrain your carefully chosen employees to ensure that your payment methods are fast, safe, and simple.

WE WANT TO HEAR FROM YOU!

How do you handle payments? Have you noticed the move to credit and debit cards and away from cash and check-based payments? How has this impacted your business? If you have a payment-related story, we’d love to hear from you! Please email your experiences to ttanker@hvacrbusiness.com.

Jenn Lonzer, M.A. is managing editor of HVACR Business and a public relations and strategic communications consultant.

This article summarizes information from the Small Business Administartion www.sba.gov.