I am often asked how much contractors should mark-up their work to make a profit. HVACR business owners are looking for the magic percentage that’ll guarantee a profit on every job. But mark-up is tricky. It’s a function of what you need to cover your fixed overhead costs plus a profit margin combined with what the market will bear. Smart business owners realize all jobs are not equal, and that mark-up should vary with every job. Using the same mark-up for every bid doesn’t maximize your profit potential or help your company make more money.

Mark-up Smaller Bigger

To determine your mark-up, first calculate how much total annual mark-up for overhead you need to cover all of your fixed general and administrative expenses. For example, if your total annual overhead is $500,000, and your total job costs are expected to be $5,000,000, you need an overhead mark-up of 10% to recover your overhead costs. Next determine how much total annual profit you want to make for the risk you take. If you want to make $250,000 annual pre-tax net profit, your net profit mark-up must average 5% using the above example. Now you have a minimum mark-up of 10% for overhead and a total profit mark-up goal of 5%, for a mark-up total of 15%.

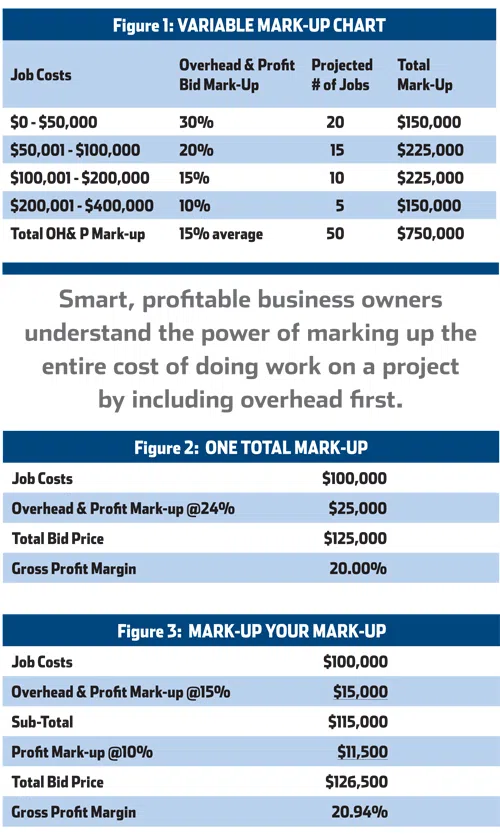

In the above example, the key is to average 15% total overhead and profit mark-up over the year. To maximize your bottom-line, consider using a variable mark-up system. You recognize the fact that smaller jobs often take the same time, energy, overhead, and supervision as bigger jobs do. Therefore, you need to charge more on smaller jobs for overhead and profit to cover the added cost of managing them plus a larger profit margin to get a return on your time and energy. I recommend you create a “Variable Mark-Up Chart” (as shown in Figure 1) similar to the example below for your company to use when marking up jobs of variable sizes. (Please don’t use these mark-up percentages – they are just examples!)

With an annual goal of 15% total mark-up and to realize your total goal of $750,000, you can make decisions about the number of jobs and at what rate you need to mark them up to meet your annual goals.

Mark-up your mark-up!

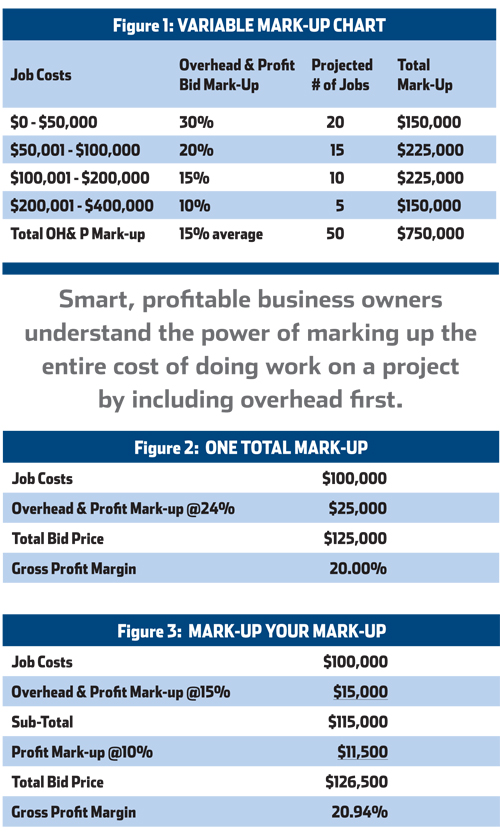

Another way to improve your mark-up strategy is to break out your overhead and profit mark-up as separate calculations. When pricing jobs and calculating the cost of change orders, most contractors leave money on the table by only using one total mark-up rate. When you blend your overhead and profit into one, with the total mark-up of 25%, you’re not marking up your fixed cost of doing business (your overhead) before you add your profit. See Figure 2 on previous page.

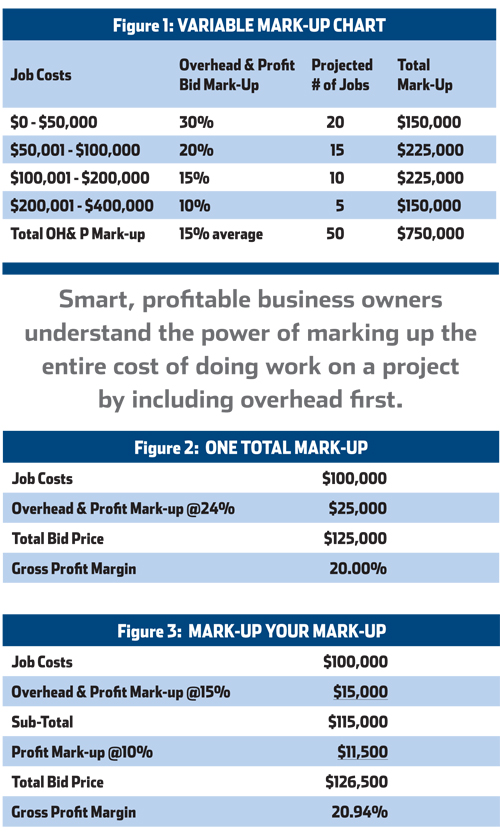

Smart, profitable business owners understand the power of marking up the entire cost of doing work on a project by including overhead first. So, mark-up your overhead costs first to boost your bottom-line. Using the same total mark-up for overhead and profit of 25%, look at a better way to mark-up your jobs

In the example in Figure 3, you made an additional $1,500 or nearly 1% more gross profit. For every $1,000,000 of total sales volume for the year when you mark-up your mark-up, your bottom-line would increase by $9,400. Not bad for a little bit of extra math.