Reflecting on performance monthly allows you to refine your strategy.

Tracking maintenance-agreement enrollments and renewals is critical to growing a strong maintenance customer base. Tracking forces you to focus. Focus gives you the best chance for success.

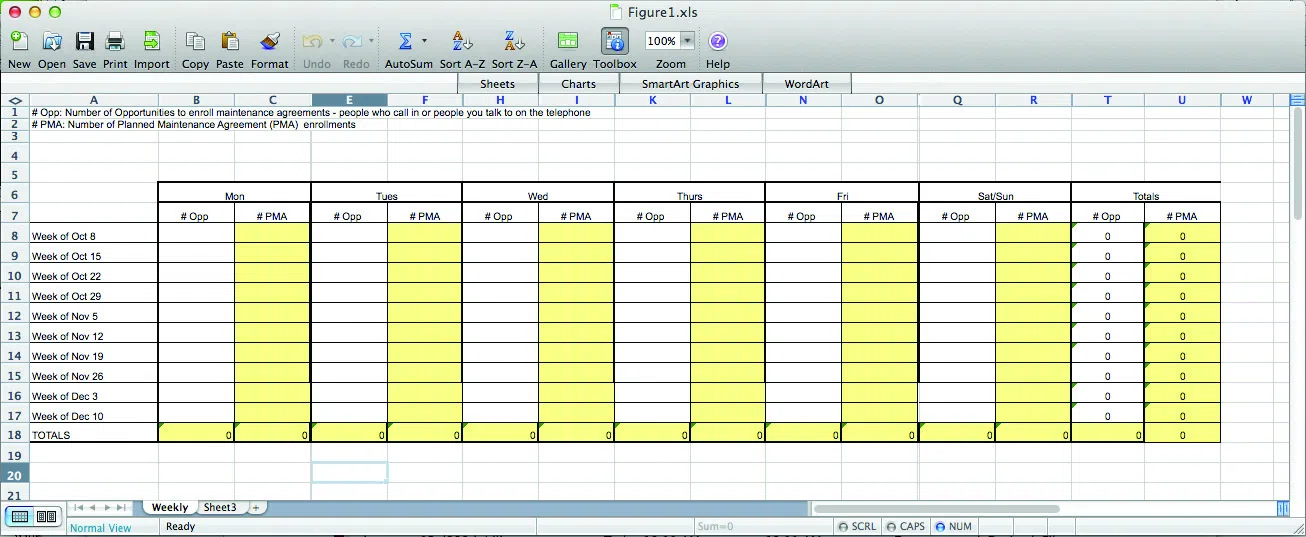

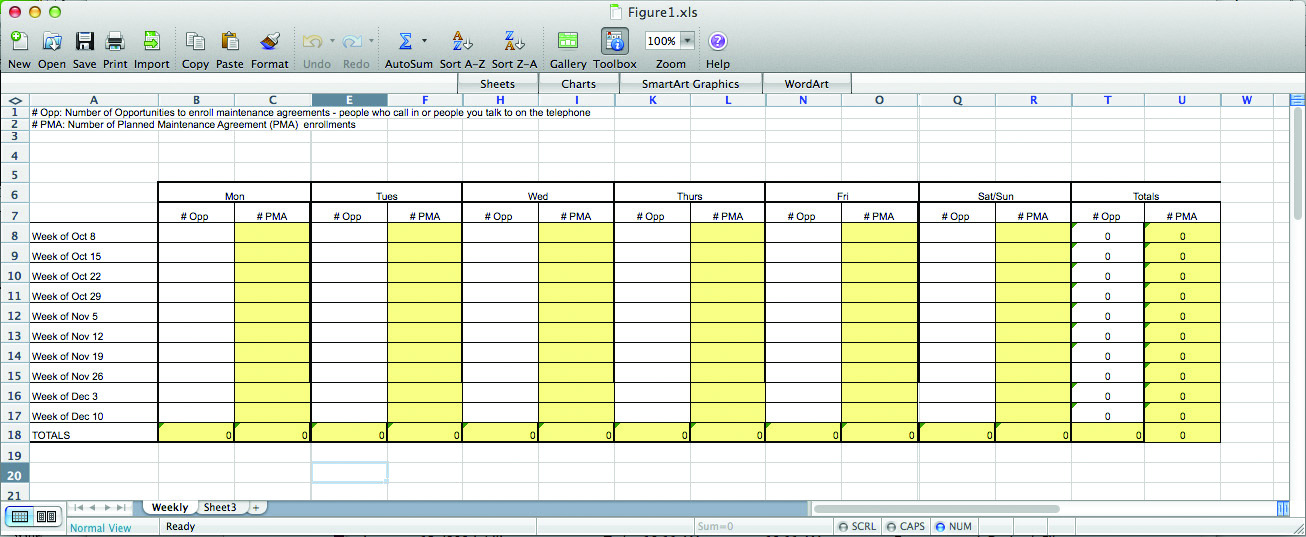

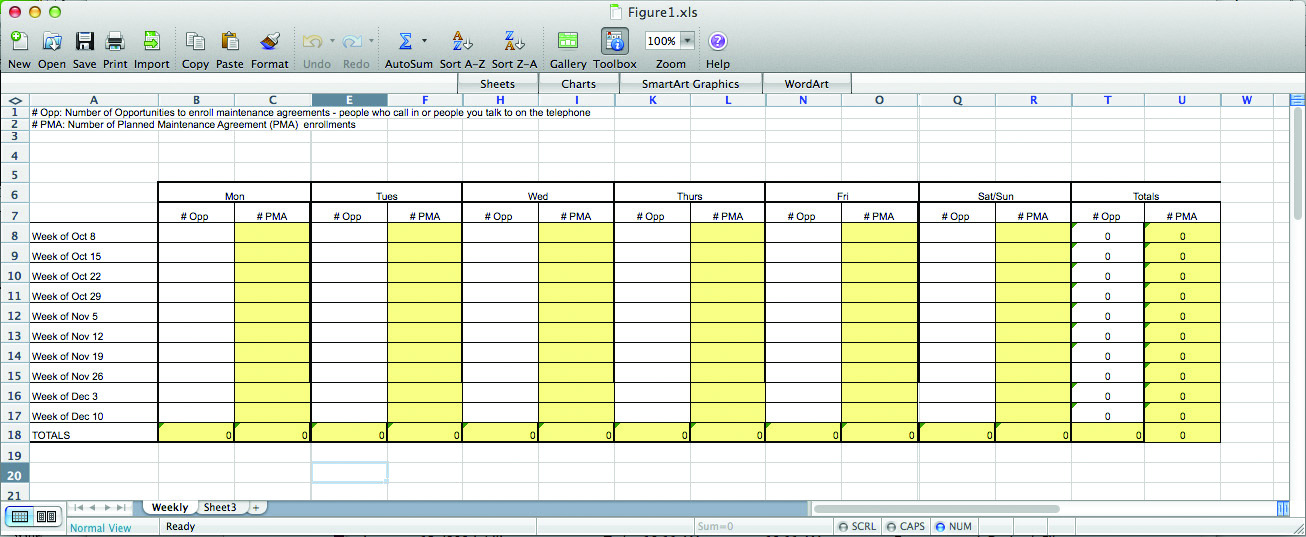

The tracking process is simple. Tracking residential maintenance agreements is simply recording the number of opportunities you have each day and the number of maintenance agreements you enroll each day. A sample residential tracking form is shown in Figure 1.

The top of the form has your goals for the year versus actual results for the year. “Opp” is the number of opportunities and “PMA” is the number of planned maintenance agreements you enroll.

I define an opportunity as any time you go to the home of a customer who does not own a maintenance agreement. The technician has the opportunity to educate the customer about maintenance, and the customer makes an informed decision about enrolling in your maintenance program.

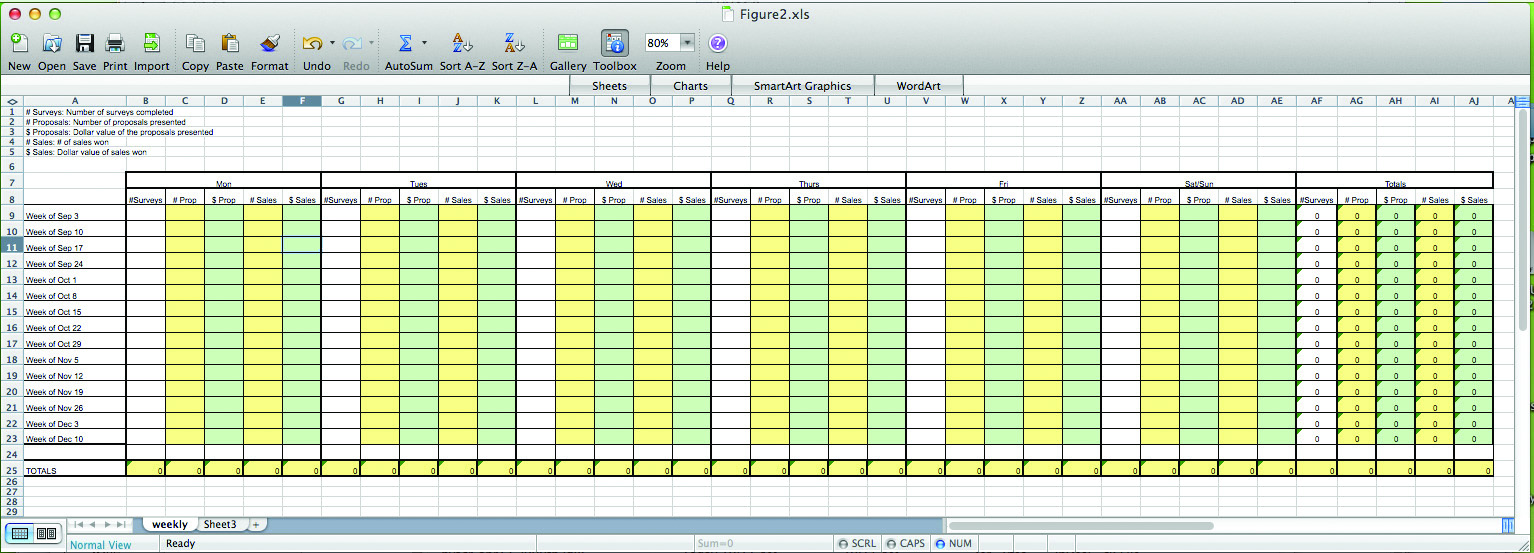

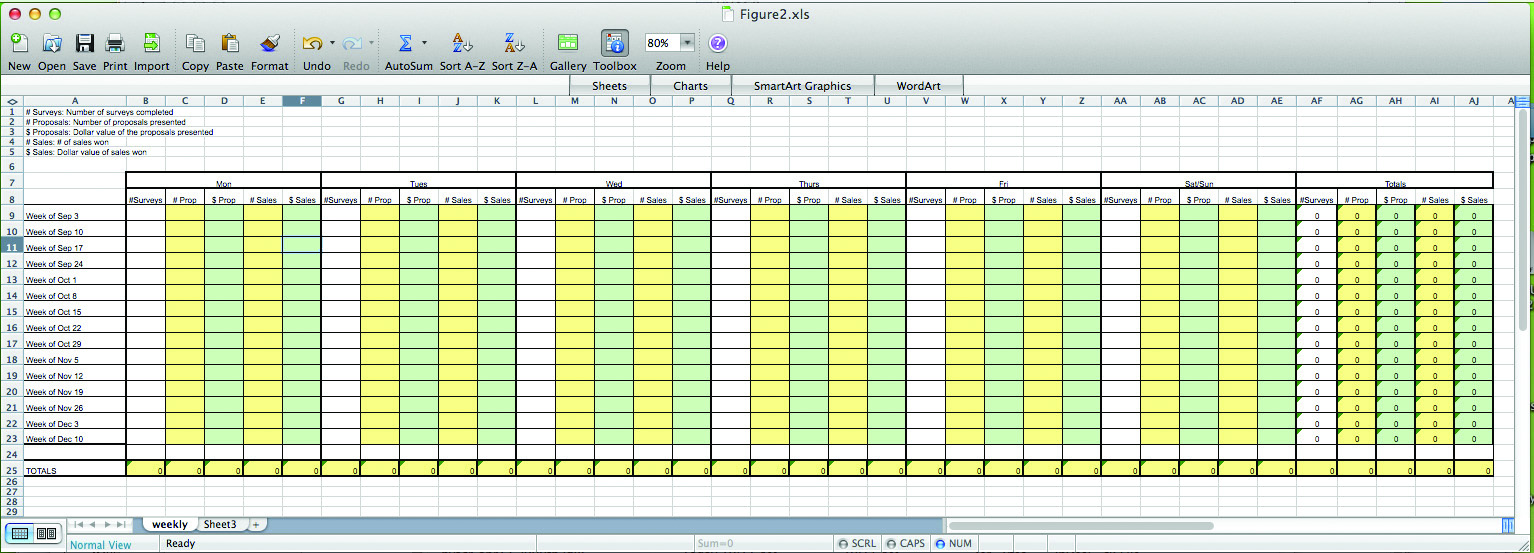

Tracking commercial maintenance agreements is simply recording the number of surveys, proposals, and enrollments you have each day. A sample commercial tracking form is shown in Figure 2.

It takes less than five minutes per day to complete these tracking forms. If you wait until the end of the week, it takes much longer because you have to remember what happened at the beginning of the week. Once you get into the habit of recording results daily, then you can see your progress every day.

Once per month, enter your actual results for that month. You can see where you are versus your goal. If you are on track or ahead of goal, celebrate. If you are behind your goal, then determine why.

Tracking on a daily and monthly basis helps you to focus on building a strong maintenance program.