Peg your plan to the calculation of overhead expenses and cash needs.

There comes a point where it is almost impossible to decrease overhead any further than you've decreased it. You've cut back on personnel, and everyone who is working at your company has taken a pay cut, including all owners. You've sublet space or moved into a smaller location and you've cut every expense that could be cut. Yet, profitability still hasn't arrived.

There is one more place to look — inventory. Can you use the materials in your warehouse? On your trucks? If you can, then you will decrease cash spending in the short term. Because inventory is an asset rather than an expense, this usage does nothing to cut expenses. However, it will decrease the use of cash, which is also important in lean times.

Using inventory in your shop and on your trucks is a temporary solution. The real answer is to grow. With as much cut as possible, the only way that you can support your company's overhead is growth.

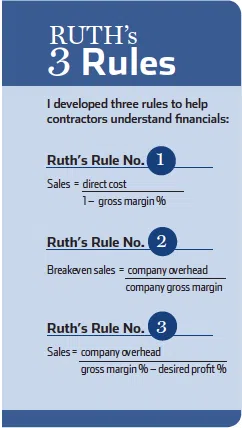

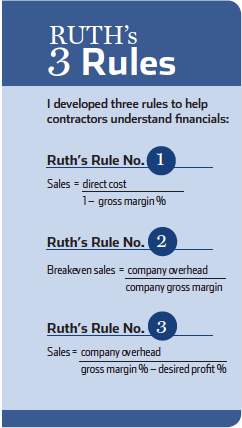

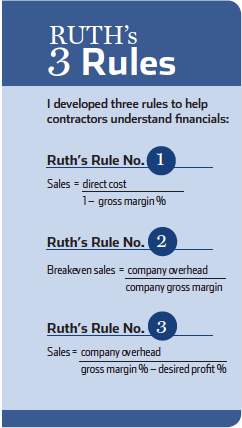

Using Ruth's Rule No. 2, calculate the breakeven sales that your company needs to sustain its overhead:

Monthly breakeven sales = Monthly company overhead / Monthly company gross margin

This is the minimum sales revenue you need to cover your overhead each month. This is NOT the cash in the door that you need unless all your sales are COD sales, you pay all your expenses COD, and you have no loan payments.

Why? Sales, cash, and loan payments are different parts of your financial statements.

Sales is a revenue (a P&L account) and cash is an asset (a balance sheet account). Loan payments are a combination of an expense (interest) and a principal reduction (liability reduction). The only piece of the loan payment that is in overhead is the interest expense.

To calculate your monthly cash requirements, determine the percentage of sales that are collected each month and all monthly cash expenses.

Divide the monthly cash expenses by the company's monthly gross margin. Then take this number and divide it by the percentage of sales that are collected each month. This gives you the sales that you must generate each month to cover the company's cash needs.

Once you know the monthly cash requirements, it's time to plan how your company can grow to cover its cash needs. You must invest in marketing. (Remember to add this expense to the monthly cash expenditures). You don't have to invest tens of thousands of dollars. Start small. Market to your existing customers first. It's cheaper, and they are more likely to listen to your messages because they've done business with your company.

Contact your active customers and give them reasons to invest in your maintenance agreements. Contact your inactive customers (customers you haven't done business with in 19 months to five years). Give them a reason to use your company's services again.

Establish a referral program. Your best leads come from your customers.

Get your customers email addresses. Use social media outlets such as Facebook fan pages, LinkedIn, and Twitter. Constant Contact can be used to send monthly email newsletters. These methods of marketing take time but not a lot of dollars.

If you've cut all that you can cut, then it's time to grow.

Ruth King has over 25 years of experience in the hvacr industry and has worked with contractors, distributors, and manufacturers to help grow their companies and become more profitable. She is president of HVAC Channel TV and holds a Class II (unrestricted) contractors license in Georgia. Ruth has written two books: The Ugly Truth About Small Business and The Ugly Truth About Managing People. Contact Ruth at ruthking@hvacchannel.tv or 770.729.0258.