Three Secrets Every CEO Must Know To Keep the Holiday Bonus Ritual From Going Horribly Wrong

Call him the workforce whisperer. Online Rewards President Michael Levy is an employee recognition expert who says it’s time to re-examine the conventional wisdom regarding the value of year-end bonuses.

Levy has created employee reward and recognition programs for clients including: Macy’s, British Airways, the U.S. Army, State Farm Insurance, BMW, Reliant Energy and many other leading companies.

The best thing that could happen to the 53% of U.S. businesses that award holiday bonuses (according to a Challenger, Gray & Christmas 2011 survey) would be a visit from the Ghost of Christmas Future, Levy says. As an employee incentive strategy, the year-end bonus is better suited to the 1840’s labor pool depicted in A Christmas Carol than the 21st century workplace.

Levy offers the following three secrets that CEOs need to know to make sure employers, large and small, get the biggest bang from the bonus buck.

Put an End to the Year-End Bonus: The year-end bonus doesn’t impact behavior. It’s symbolic, rather than strategic. The current generation of employees requires instant gratification for recognition to be impactful, and recognition should be tied to individual behaviors in real-time. Holiday bonuses are too far removed from the positive behaviors that are completed throughout the year to be meaningful – and they don’t relate to the actual contributions of the individual employees who are generating the outcomes.

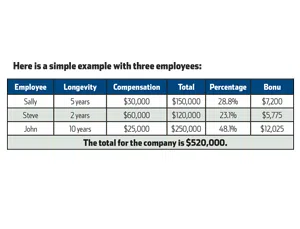

Performance Over Entitlement Traditions: Innovative companies are re-aligning holiday bonus budgets, aligning them with individual performance instead of applying them to the traditional holiday bonus. Instead of a lump sum payment once a year, savvy employers are creating reward and recognition programs that recognize and reward at the time of the behavior. These timely bonuses distinguish between employees based on their individual performance. They strengthen relationships between employees and managers. Year-around performance-based programs promote behavior that advances the company goals and impact employee perceptions in a significantly more real and frequent basis than annual holiday bonuses.

Make It Meaningful: Electronics, gift cards, travel vouchers and movie passes serve better as rewards than cash because they’re indulgences the employee might not otherwise experience. Cash is used to cover the day-to-day realities and responsibilities (mortgage payments, insurance, credit card bills and utilities). When you think back on the gifts you have historically received, do you recall more readily the cash, or, more likely, the tangible gifts. It’s simply impossible to make cash any more interesting than it is? Non-cash rewards convey a deeper message. Getting the reward just right -- that’s the science of great incentive design.

As CEO of Online Rewards, Michael Levy has been personally involved in the program design for over 100 U.S. and international reward programs for organizations including Fortune 500 global companies and the U.S. government. Online Rewards is a leading provider of incentive and loyalty marketing programs that change behavior. Online Rewards is www.online-rewards.com.