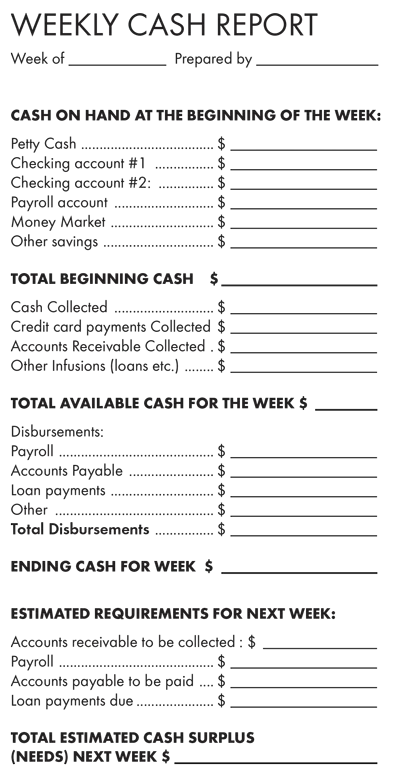

Managing finances properly and removing errors from reports are key factors.

Your credit score can be the key to home ownership, an auto loan, consumer credit, and even employment. How much do you know about this three-digit number that holds so much power over you?

Creditors have been using credit scores for decades, but they have become available to consumers only in recent years. It makes good financial sense to understand credit scores and how they impact your life.

Why It Matters

Your credit score summarizes your creditworthiness (how likely you are to repay a financial obligation) based on the information in your credit report compared with millions of others. The higher your credit score, the lower the risk a lender takes in providing you credit, and the better your chance to obtain credit and low interest rates.

Credit scores have become even more important as other entities such as employers, insurers, landlords, and other businesses use them to make quick decisions about you.

What Matters Most

The formulas used for credit scoring are complex and tightly held secrets (though some have disclosed general guidelines), but certain key factors are considered in most scoring models:

Payment history: More than anything else, lenders want to know how you pay your bills.

Amount owed: Creditors are interested in how much credit you already have committed to. Even if you pay your bills in full each month, your credit score may factor in a large balance that was not paid when your credit score was calculated.

Available credit: Creditors care about how much credit is available to you, but mostly about how you handle your available credit.

Length of credit history: A longer credit history is viewed favorably by lenders. For that reason, it is rarely a good idea to close old accounts, even if you aren’t using them.

Types of credit: Having a proven track record with a variety of types of credit (mortgage, car loan, credit cards, etc.) is viewed positively by creditors. However, it is seldom wise to apply for credit you don’t need just for the variety.

New credit: Many scoring models factor in applications for new credit by looking at “hard inquiries” on your report — those that result from an application you initiate. Unless they are excessive, inquiries usually have a minimal impact on your credit score. However, it is something to think about when you fill out a credit application in return for a coffee mug, duffel bag or 10% off today’s purchases.

Time: Negative information can legally remain on your credit report for seven years (or 10 years for bankruptcies), but most credit scoring models take into consideration how old negative data is.

How much certain factors affect your score depends greatly on the rest of the information in your credit report. As the information in your credit report changes, the importance of certain factors on your credit report also changes.

The best advice for improving your credit score can be summarized as “Manage your credit responsibly over time.” Here are some specific tips to consider:

- Pay your bills on time, every time.

- Keep credit card balances low in proportion to credit limits.

- With revolving credit, such as credit cards, lines of credit, and home equity loans, your average daily balance should be 50% or less of your high limit.

- Keep and use old accounts. These help establish the length of your credit history.

- Minimize new credit applications. This is especially true when you have a “thin” credit file without a lot of credit history.

- Avoid bankruptcy. Declaring bankruptcy is one of the worst things you can do for your credit score.

Check Your Report

Your credit score will never be more accurate than the information in your credit report. Studies show that up to 80% of credit reports contain an error. The worst one is the one you don’t know about. A credit-monitoring service can help you keep tabs on all three of your credit reports around the clock.