If you have a profitable business, a qualified retirement plan is a great way to reward yourself, and key employees, for that success. Several scenarios will help you choose the right plan for you and your company.

“The question isn’t at what age I want to retire, it’s at what income.” — George Foreman.

Indeed, properly planning for retirement will ensure you retire with the income you desire. But for many hvacr contractors, retirement is a foreign concept and providing retirement benefits to employees is a challenge.

However, there is much more flexibility in the pension law than is commonly appreciated by employers. For example, the law does not require that you cover all of your employees under a plan. Even the most conventional retirement plans are permitted to exclude up to 30% of an employer’s non-highly compensated employees. It is even possible to exclude more than 50% of your non-highly compensated employees, so long as certain non-discrimination rules are satisfied.

Likewise, the law does not require that all employees receive the same percentage contribution. In our experience, it is rather common for the contribution on behalf of the owner and other key employees to be as much as three times the percentage contribution on behalf of rank-and-file employees.

Finally, it is not necessary to cover all employees in the same retirement plan or in the same types of retirement plans. By covering different categories of employees in different types of retirement plans, we can frequently reduce employer costs while enhancing benefits for the owner and other key employees.

Before showing you how these rules can work to your advantage, it is important for you to have an understanding of the different types of retirement plans that are available to small businesses. The first part of this article will provide you with information regarding the different types of retirement plans. The second half of this article will show you how a plan might be designed for a small hvacr business.

The flexible rules we’ve discussed above apply to traditional qualified retirement plans, but there are other, simpler plans available to small businesses. A “SEP” or “Simplified Employee Pension” is one such plan. Under a SEP, employers make contributions to traditional individual retirement accounts (IRAs) that they set up for their employees. The contributions made by the employer are fully vested and nonforfeitable, meaning that they become the employee’s property as soon as they are made. Contributions must be made for every employee who is at least 21 years of age and who has performed services for you in at least three of the last five years. You can contribute up to 25% of pay for each employee (to a maximum of $46,000), but each employee must get the same percentage contribution.

Another alternative (for employers with less than 100 employees) is a SIMPLE IRA plan (Savings Incentive Match Plan for Employees). Under this type of plan, both employers and employees make contributions to IRAs that are set up for the employees. Although this plan may not include an age requirement, it can be limited to employees who have received at least $5,000 in pay during any preceding two years and who are expected to earn at least $5,000 of pay in the current year. Employees can contribute up to $10,500 to their SIMPLE IRA, plus an additional $2,500 if they are age 50 or older. The employer is required to make a 2% contribution on behalf of all employees, or alternatively, to provide a dollar for dollar matching contribution up to 3% of pay for those employees who elect to make contributions on their own.

Both SEPs and SIMPLE plans are relatively easy and inexpensive to establish. The Internal Revenue Service provides form documents for these types of plans. Additionally, the recordkeeping that is required is minimal.

“Qualified retirement plans,” which refer to a retirement plan that meets the qualification requirements of Section 401(a) of the Internal Revenue Code, are more complex than SEPs and SIMPLE IRAs, but they are also more flexible and can be designed to meet the specific objectives of a particular employer.

There are two types of qualified retirement plans: defined benefit plans and defined contribution plans. Defined benefit plans are more commonly adopted by large employers. These plans promise employees a specific benefit payable of a specified retirement age (for example, 30% of average monthly pay beginning at age 65). The employer contributes whatever amount is necessary to pay for the promised benefit. The employee’s benefit is not affected by the investment performance of the plan. If the plan loses money, the employer is required to contribute additional money to pay for the promised benefit.

Defined contribution plans include profit sharing plans and money-purchase pension plans. Under these types of plans, each participant has an individual account to which contributions, earnings, and losses are credited. The employee’s ultimate retirement benefit depends upon the amount of contributions made during the employee’s career and the earnings or losses on those contributions. Defined contribution plans are, in effect, a tax-sheltered savings account to which the employer, and in many cases, the employee, make contributions.

There are two types of defined contribution plans: profit sharing plans and money purchase pension plans. The plans operate very similarly. The most significant difference is that employer contributions to a profit sharing plan are discretionary and employer contributions to a money purchase pension plan are mandatory.

A Section 401(k) plan is actually a type of profit sharing plan, one to which the employee can make contributions. The maximum annual amount that can be contributed to a Section 401(k) plan by an employee is $15,500, plus an additional $5,000 for employees who are age 50 or older. A Section 401(k) plan may include provisions under which the employer makes a discretionary contribution and/or a matching contribution. Section 401(k) plans are now the most common type of qualified retirement plan.

Historically, Section 401(k) plans have been difficult to maintain in small companies because of their complex non-discrimination rules. However, a few years ago, Congress created “safe harbor” section 401(k) plans, which are exempt from the non-discrimination rules. The safe harbor rules have made Section 401(k) plans very attractive for small employers.

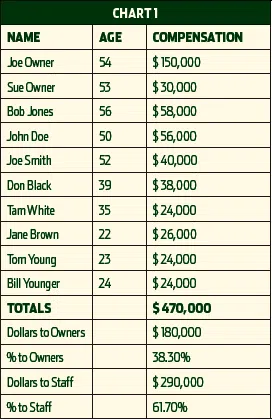

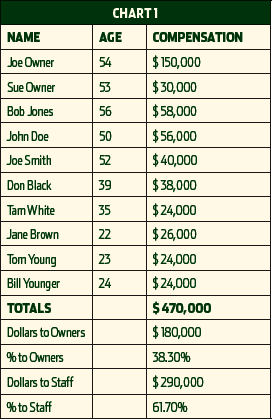

With this background, we can consider how a plan might be designed for an employer. Look at Chart 1— Joe and Sue Owner, a married couple that owns a small, profitable hvacr business with eight employees.

Besides being the president, Joe is the company’s best salesman, and he also supervises the technicians. Sue oversees the office with the help of Tam and Jane. Bob Jones, John Doe, and Joe Smith are senior technicians and have been with the company for quite some time. Don Black, Tom Young, and Bill Younger are technicians’ helpers and are relatively new to the business. Joe and Sue are interested in adopting a retirement plan, primarily for their own benefit. However, Joe sees the need to take care of his three senior technicians and will not mind benefiting them.

The business is doing well, and Joe and Sue are interested in saving as much as possible on a tax deferred basis. They considered a SEP, but for them to save $27,000 (15% of pay), the company would have to contribute $43,500 for their employees. A SIMPLE IRA, using the matching contribution provision, is somewhat attractive. Joe and Sue could each defer $13,000 and they would share a matching contribution of $5,400. Thus, their combined savings would be $31,400. The required employer contribution will depend upon how much is deferred by their employees, but the most it will be is $11,600.

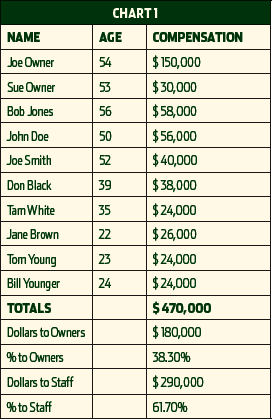

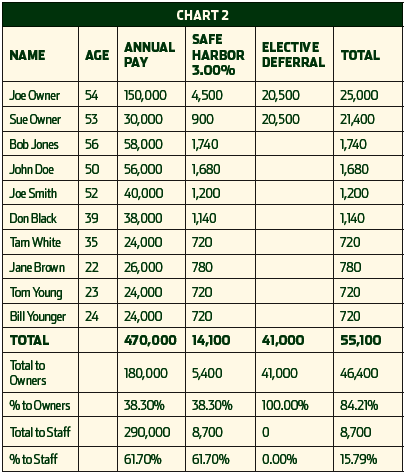

While this is a pretty attractive result, a safe harbor section 401(k) plan might provide an even better result. Under a safe harbor section 401(k) plan, the employer promises to make a fully vested contribution on behalf of each employee. In exchange, each employee can defer up to $15,500 into the plan. Employees age 50 or older can put away an additional $5,000 as a “catchup” contribution. There are two types of safe harbor contributions. The first type is a 3% contribution that is made for all employees.

Chart 2 shows the costs and potential benefits for Joe and Sue, using the 3% contribution safe harbor.

As you can see, by committing to a contribution of $8,700 for their employees, Joe and Sue are able to putaway $46,400 for themselves.

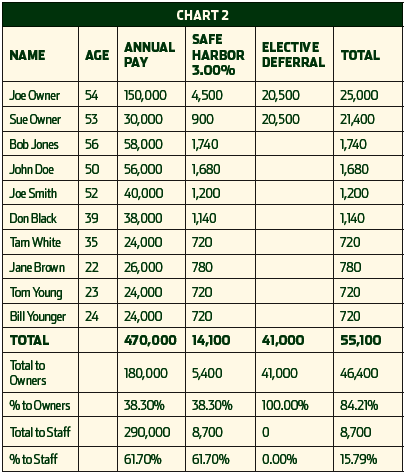

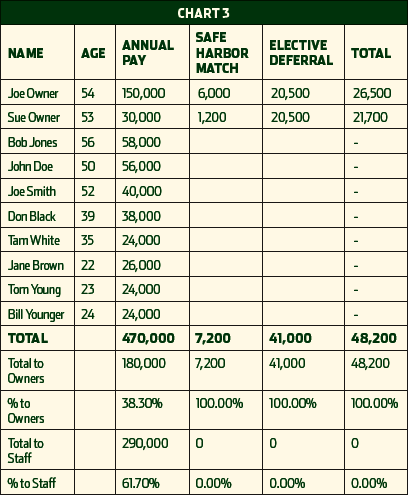

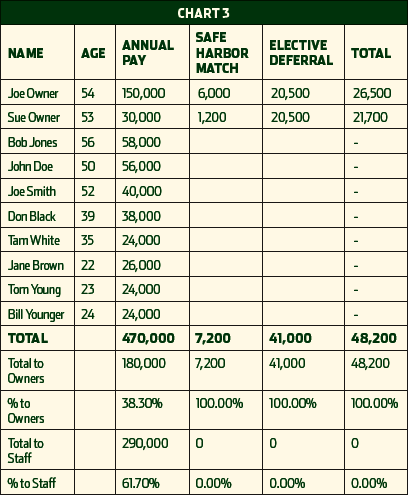

The second type of safe harbor contribution is a matching contribution. The employer promises a fully vested matchingcontribution on behalf of each employee who makes an elective deferral. The matching contribution is 100% of the first 3% of pay deferred by the employee plus 50% of the next 2% deferred by the employee. Thus, if an employee defers 5% or more of pay, that employee receives a matching contribution equal to 4% of pay. Unlike the first safe harbor where every employee gets a contribution, the matching contribution is only made for those employees who elect to defer some of their wages into the plan. Chart 3 shows the costs if only Joe and Sue make deferrals.

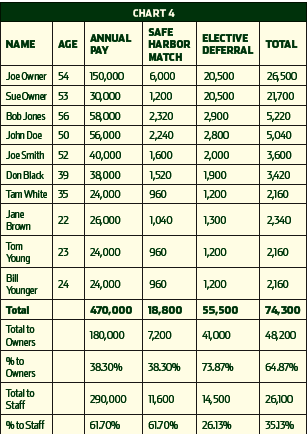

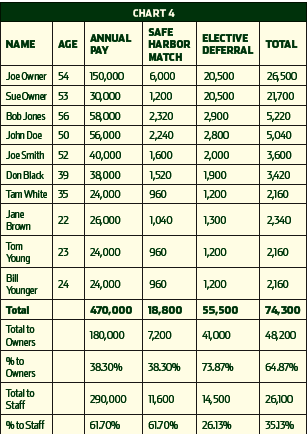

Chart 4 shows the cost if every employee defers at least 5% of pay.

Although the matching contributions safe harbor is potentially more expensive than the 3% safe harbor, it is rare that all employees make a 5% elective deferral. In practice, the matching contributions safe harbor is usually the less expensive alternative. In either case, Joe and Sue have the opportunity for very significant savings with relatively low cost.

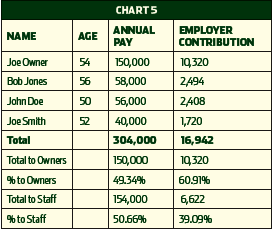

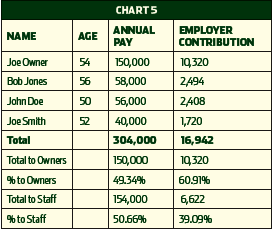

While Joe and Sue are happy with this design, they are somewhat concerned that the plans do not do enough for the company’s senior technicians. Their advisor suggests that the company adopt a safe harbor section 401(k) plan using the matching contribution provision, and adopt a second plan covering only Joe and the three senior technicians. The company has eight non-highly compensated employees, and therefore, the plan must cover only three of those employees. Using some special non-discrimination rules included in the Internal Revenue Code, the contributions in the second plan are noted in Chart 5.

With these two plans operating together, Joe and Sue Owner will be able to save in excess of $58,500 per year. The cost for their employees will range from $6,600 to just over $18,000, depending upon the level of participation of their employees in the section 401(k) plan.

These examples really only scratch the surface in showing the flexibility that is inherent in the law. If you are in a position to save, it is quite possible to develop a retirement plan that will allow you great savings opportunities without breaking the bank with employee costs.

Michael P. Coyne is a founding partner of the law firm Waldheger Coyne, located in Cleveland, OH. For more information of the firm, visit: www.healthlaw.com or call 440.835.0600.