For this installment — the first of a three-part series — we spoke with the following contractors:

Edd Hill, president of HVAC, Inc., Bristol, TN, a major Design/Build, mechanical contracting, electrical, plumbing, IAQ, project tracking, and building automation control firm. Hill founded the company in 1986.

Skip Snyder, president of Snyder Co., Inc., Upper Darby, PA, which specializes in hydronics and combustion with some cooling work. Snyder has been actively involved in the industry since the 1970s and is a past chairman of the Air Conditioning Contractors of America (ACCA).

Tommy Castellano, CEO of Castellano A/C & Heating Inc., Tampa, FL, ACCA's 2006 Residential Contractor of the Year. Castellano founded the company in 1976. It specializes in residential services including Design/Build, but also does some government and light commercial work.

Hugh Joyce, president of James River Air Conditioning Co., Inc., Richmond, VA, a company his father founded in 1967. The company has received numerous awards, including Small Business of the Year for Richmond and the state of Virginia. Joyce is a past president of ACCA.

Over the upcoming months, watch for additional input from other industry segments. HVACR Business thanks all who participated. We're confident you'll find their input valuable.

Where do you see the industry heading over the next five, 10, 20 years?

Hill: I think we'll see the major manufacturers trying to increase their market share by increasing their efforts to sell equipment and services to end-users. Performance contracts, OEM financing, and joint ventures between OEM and mechanical contractors will be more prevalent. Successful contractors will learn how to team with the OEMs on these projects.

The contractor will see more competition from the OEMs for service contracts. Contractors don't like this, but I don't think we can stop it. On the other hand, the OEMs can't just disregard the contractors either, because they're going to have to rely on local labor to install their systems. In my experience, contractors are just more efficient and cost-effective than OEMs at performing this work. I can't see manufacturers wanting to add more employees to do what the local contractors are set-up to do.

More end-users will begin to see the benefits of "leasing" HVAC systems. It makes it easier for them to plan if they know that their HVAC costs will be "X" dollars per month and that someone else will be responsible for repairing the systems.

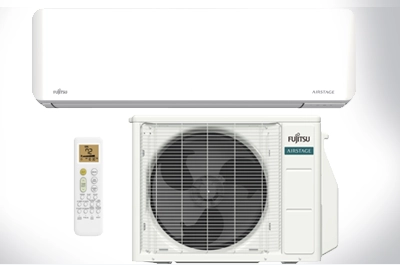

I see more competition from off-shore manufacturers in the future. Mini-splits have been coming in from Japan for years. I expect this to continue and to see other products such as chillers, pumps, etc., come in from abroad, as well.

The shortage of qualified trained labor will become even more acute. This should cause wages to increase. It should also make contractors and manufacturers look at ways to design, build, and install systems that require less labor to install and maintain.

Smarter equipment will be hitting the market, such as systems that can self diagnose. Integrated controls that can learn and adjust to changing conditions will be developed.

Energy cost will become a greater driver of equipment innovation in the future. Higher efficiency equipment will either be mandated by the government or demanded by the end-user, or some combination of the two. Since the recent increases in natural gas, propane, and fuel oil costs, we have had renewed interest in energy efficiency. Geothermal ground-source heat pumps will become more popular. With higher fuel costs and continuing innovation, solar and other alternative systems will begin to be more affordable.

Snyder: Over the next five years, I see a gradual shift in technology resulting in better productivity, a reduction in mistakes, and fewer redundant efforts. Technology will also allow immediate communication on a number of levels resulting in fewer mistakes, reducing losses in life and property, resulting in a shift to a cleaner environment.

Over the next 10 to 20 years, I think technology will dramatically reduce equipment failures; provide for smart equipment, including voice annunciation; allow for modular and easier repairs; eliminate small parts and guessing games; and allow for the anticipation of problems/failures, reduced energy consumption, and lower pollution.

The technician of tomorrow will have a cell phone that will be a portable computer, wallet, and diagnostic tool, with keys to the service vehicle and home. This technician will have at least two years of college, but most likely a four-year degree, and in many cases, will be bilingual and schooled in "human interaction." The well-educated technician will be the salesperson of tomorrow.

The equipment used by the technician will include upgraded "global positioning" and automatic routing for the most efficient method of travel. Since diagnostics will be an "art form," the vehicles will be smaller hybrids with annunciation programs for truck inventory. The tracking of travel, fuel consumption, labor, and inventory will be interwoven into each truck, allowing for bonus plans for the more innovative and productive technicians.

Advances in medicine will allow older technicians to work in the field longer. Younger technicians will most likely be bilingual, first-generation Americans.

Castellano: Over the next five years, the cost of raw materials will continue to rise. Manufacturers will begin to produce more 410A equipment. Already, 13 SEER has been beneficial to quality contractors who are selling higher efficiency equipment and moving their clients into 410A equipment. With the manufacturers offering 10-year parts warranties, service companies will lose service dollars on parts, which will have to be made-up by selling accessories to remain profitable. Service rates will have to be adjusted to maintain profitability. That is why flat rate pricing is so popular. Service contracts will have to become a major part of the service department to tie customers to the company for future replacement.

The major problems that we'll encounter include high insurance costs, which will continue to rise. Gas is only going to go up. The shortage of labor will remain a problem, but will start to ease in the next five years. Vocational recruitment will increase and many trade associations, manufacturers, and suppliers will be actively involved with educating a labor force for the future.

Indoor air quality (IAQ) will only grow in importance over the next five years. Manufacturers are doing a good job of selling homeowners on the idea, and more customers are asking for IAQ products. Duct system replacement and duct cleaning are becoming big businesses.

Within five to 10 years, equipment efficiencies will continue to increase. Housing will begin to slow down a bit, but demand for service will increase. Health care will begin to be affordable because contractors all over the country will be allowed to unite and have real purchasing power. Workers compensation will finally be brought under control -- just for the fact that insurance investigators, employers, or both will investigate injury claims rigorously. The labor force will improve. Tech training will begin at the high school level. The demand by the market will force school boards to recognize that not all kids can go to college.

Eventually, researchers will discover an alternative to gasoline. It may not be any less expensive in the beginning, but it will be plentiful. The replacement market will be tremendous. While new housing starts will continue, the big dollars will be in replacement. Service will be easier for technicians with new technologies that will do most of the troubleshooting. In many cases, techs will be able to repair systems from remote locations. Equipment will be equipped with sensors to let the customer's service company know when the system needs service.

Joyce: We hope to see manufacturers produce equipment that will allow us to better manage energy use — equipment that will have enhanced diagnostic capabilities, wireless capabilities, and the ability to integrate with the thermostat. We hope for smaller, quieter, more user-friendly equipment that does not leak and cause mold growth and IAQ issues.

In regard to diagnostics, there is no standardization at all. This leads to inefficiency in the field. We are behind the curve in this area, and need to do better. We also look forward to a wireless world, where ideally, we will be able to pull up, examine, and service units on the Internet.

What do you see as some of the key trends?

Hill: We will all have to learn Spanish. This is a fact. We are not growing labor in our country. We will have to import it, and for the foreseeable future, this labor will be Latino.

The Internet will continue to play an increasing role in the way we do business. From the proposal/bid process, to procurement, to training, the Internet will be a key tool in every business.

Although consolidation hit a wall a few years back, I do not think it is dead. The industry will learn how to successfully consolidate. It just makes sense to share accounting, training, labor, and financial assets.

Snyder: 1) Easier troubleshooting via technology such as self diagnostics, remote communication, computerized inventories, and modular construction. I also envision the HVAC system notifying the utility when it goes into a "wasteful mode," resulting in excessive consumption and pollution.

Installations and controls will be governed by the energy provider for the most part. Since we are currently struggling with oil costs, I'll assume it will be an ongoing problem. This will lead energy providers and governments to offer incentives for "accredited" installations by accredited/certified professionals.

Choices for options, controls, and equipment will be as limitless as your pocketbook. The return on investment (ROI) will become more of a selling point, especially with give-backs from energy providers and governmental agencies. We also need to factor in foreign manufacturers in the mix of products. China is becoming a manufacturing giant which could change how we go to market.

2) A demographic shift. The baby boomers will be moving into retirement and many will be migrating to the South and West. Construction will boom in those areas and business opportunities will be substantial. Immigrants will fill many of the technician jobs.

3) The endless "fight for the customer" between various factions. National account groups, manufacturers, contractors, mega-contractors, high-bred environmental consortiums such as "whole house" contractors, insurers — each vying for ownership of the residential and commercial customer. Over time, small, independent contractors could lose ownership of customers, making them nothing more than labor brokers.

4) More education. Contractor and technician certification is a must. The industry must establish a "professional" bar of excellence. North American Technician Excellence (NATE) is an excellent example of this for the technician. The Air Conditioning Contractors of America (ACCA) and other industry leaders are working toward a contractor and installation "standard of excellence" — a quality accreditation program.

5) The cost of doing business. The business environment is not a level playing field. The "association health care" legislation is just one of many issues that independent and small business owners must address. There are a number of costs that constructively eliminate the small contractor from competing. As competition heats up for the better customers, this disparity will play a larger role. Once again, industry associations will show their value.

6) Our society will continue to become more multicultural, resulting in a diverse work force. This will add to the challenges of operating a business, as we see new developments in regard to language, religious customs, work ethics, dress codes, personal grooming, training, etc.

Castellano: The key trends I see are increased needs for employee education and training; the addressing of insurance costs; more government regulation of our industry at the local, state, and federal levels; more partnerships with manufacturers; greater increases in the costs of doing business; more need for employer education; and a continuing growth in the popularity of the Internet.

The ways that companies hire and train employees will have to improve. Not all employees can be trained to do certain jobs. It's important to determine what a job candidate can excel at, and give him or her the opportunity to succeed — then, you'll have a team member.

Joyce: This is a great time to be in this industry. We're going to see more concern over global warming, and more extreme weather. Over the course of their lifetimes, more people will be owning more homes and will therefore be wanting, buying, and using more of our products.

We will need to continue to find ways to keep people comfortable while saving energy. Improved control strategies, better building envelopes, and higher-efficiency equipment will all come together to create the "perfect storm."

What will be different in terms of the features and benefits that customers will be asking for?

Snyder: The contractor still has tremendous influence on which system the customer installs — let's not lose focus of this fact. We do, to a certain extent, control some of the marketplace and decision making. System "add-ons" relating to monitoring efficiency and operation will become the "norm" due to higher energy costs. The contractor will be in competition with others to be the "link" to the HVAC system when it calls for service.

Castellano: Most customers want energy efficiency. They all want to save money. The 410A equipment, even though it is a little more expensive, is easily sold. People don't want to have to worry about the refrigerant change. They know that R-22 systems will soon become extinct. Customers also want long warranties for peace-of-mind. They like digital thermostats for accurate temperature readings. Color does make a difference if offered. Customers are finding options on the Internet and shopping for brands they are familiar with. Teaming up with manufacturers through advertising will help those customers find you.

Basically, we're in the problem-solving business. It's a myth that people don't want to spend money — or that they want it as cheap as possible. When faced with a major buying decision, homeowners want the best value for their dollars, and that means choices. Many homeowners are naïve to features and benefits. Do you realize that an air conditioning system is probably the third most expensive item a homeowner will purchase? Yet how many actually go out to shop for an air conditioning system?

Unless they are having a home built, most customers want what the contractor recommends. The smart contractor offers a variety of equipment, clearly spelling out the features and benefits. When examining their choices, homeowners are smart enough to know what the best solutions are, and will be willing to pay for them. The purchase then turns into an investment that will more than pay for itself during the lifetime of the equipment. The customer already expects energy savings, since the government has set standards. The air conditioning contractor who just sells boxes doesn't get it. He hasn't realized the best solutions and maximum benefits for his clients, nor has he realized the maximum profit for his company. The contractors who know this will thrive.

Joyce: Over the last two or three years, consumers have become much more knowledgeable, thanks in large part to the Internet. We welcome that. Consumers want efficient, invisible equipment with good technological interface, and the ability to monitor it. They're looking for perfection.

What are some of the major challenges your business — and the industry — will face?

Snyder: 1) Proprietary information held by manufacturers concerning equipment operation that is not shared with contractors is a major challenge. The automobile industry is currently battling over this problem; independent service dealers are being limited on access to information on some proprietary information. If this takes hold in the HVACR industry, the contractor may be constructively eliminated from some areas of the industry. My initial solution to this problem is to negotiate a program to "qualify" contractors and technicians via a neutral vendor, establishing a "certification program" allowing them to work with proprietary systems.

2) Insurance costs, specifically medical insurance and retirement programs. We need to work on a solution not only as an industry, but as a society. My answer to this problem is to start with developing legislation for a "national association health care plan," working with many different groups to assure fair treatment at a competitive price. This is only a first step; we need to work with other industries including the medical groups to come to a reasonable solution.

3) The world is becoming flat — global competition will start to change our equipment patterns. Look at the dramatic changes in the auto industry. Is the HVACR industry that far behind? This is not a challenge for the contractor to "overcome," but it may be an opportunity to thrive and prosper.

Castellano: There has never been a better time to be in the HVAC industry. The government has made energy efficiency mandatory and higher efficiency cost more, which means we can sell it for more. The opportunities for growth are tremendous, but it will take dedication to planning for this growth. That plan has to include bringing young people into this business and training them to be the best they can be.

Joyce: Our biggest challenges involve people — how to attract, train, and retain them; managing risk in areas such as mold and liability; rising health care costs; commodities — getting all the materials we need to do our work; and energy costs — but this is also an opportunity. We need to develop fuel alternatives, and the government must take the lead.

Describe the contractors who will thrive, those who will merely survive, and those who will go along the wayside.

Hill: Contractors who embrace change, learn new technologies, and concentrate on adding value for their customers will have more of a chance to thrive. Those who continue to run their business the way they ran it in the past are the most likely to disappear.

Snyder: Those who thrive will invest in their people, educate them, stay informed, meet with their peers, and stay active with associations. They will look at their employees as their greatest investment, and at education as an investment, not an expense. Contractors who engage in industry activities and learn the "lay of the land" will formulate strategies to excel.

Those who will merely survive are those who treat the profession as merely a "job." This includes contractors who "imitate" successful companies, but who don't really understand the underlying dynamics of the organizational skills necessary to operate a truly successful business.

Those who go along the wayside will typically be the price-sensitive contractors; low-bid contractors; those who promise but don't deliver; those with high employee turnover, minimal benefits, poor equipment to work with, poor company morale, and no or minimal education on business.

I challenge each reader to review the economic environment in the 1970s and 80s to decide if their business is sturdy enough to survive. Contractors such as myself who were in business back then struggled with a 40% market crash, gasoline lines, 20.5% interest rates, and a series of other challenges, but somehow we survived, and in fact some of us prospered. If you have doubts, start educating yourself now: Join ACCA and an ACCA MIX Group®, attend conferences, and read industry publications.

Joyce: Those who thrive will love the business and their work. They will invest in training and education and work to improve their marketplace. Those who merely get by may enjoy the work, but only have a part-time mentality. Those who die will include anyone who doesn't want to embrace new technologies; anyone who doesn't charge appropriate prices to invest in the right people and products; and those who can't handle the demands of their customers.

Castellano: There is a difference between being a service tech who owns a business and a businessperson who owns an HVACR company. While a service tech can repair most air conditioning systems, the businessperson must know the difference between gross income and net profit. A service tech can sometimes manage himself. A business owner must be able to manage people and business systems. The biggest challenge is making that change. I believe that many owners can't make that transition. Those are the ones who barely survive, but seem to hang on. It takes an overhaul of beliefs and education. They must see things in a different perspective. Those who can't, go by the wayside.

The key to success will be managed growth. A company can increase its client base without forfeiting profit. When you can provide tremendous customer service in a world where service doesn't matter, then you can experience growth because your customer will pay more for tremendous service. How do you provide tremendous service? It's really no secret. Just look around and do the opposite of what the others are doing. Then say "thank you" — say it often and mean it.